Banks just released their new fixed interest rate home loan packages. What does this mean for you as a homeowner?

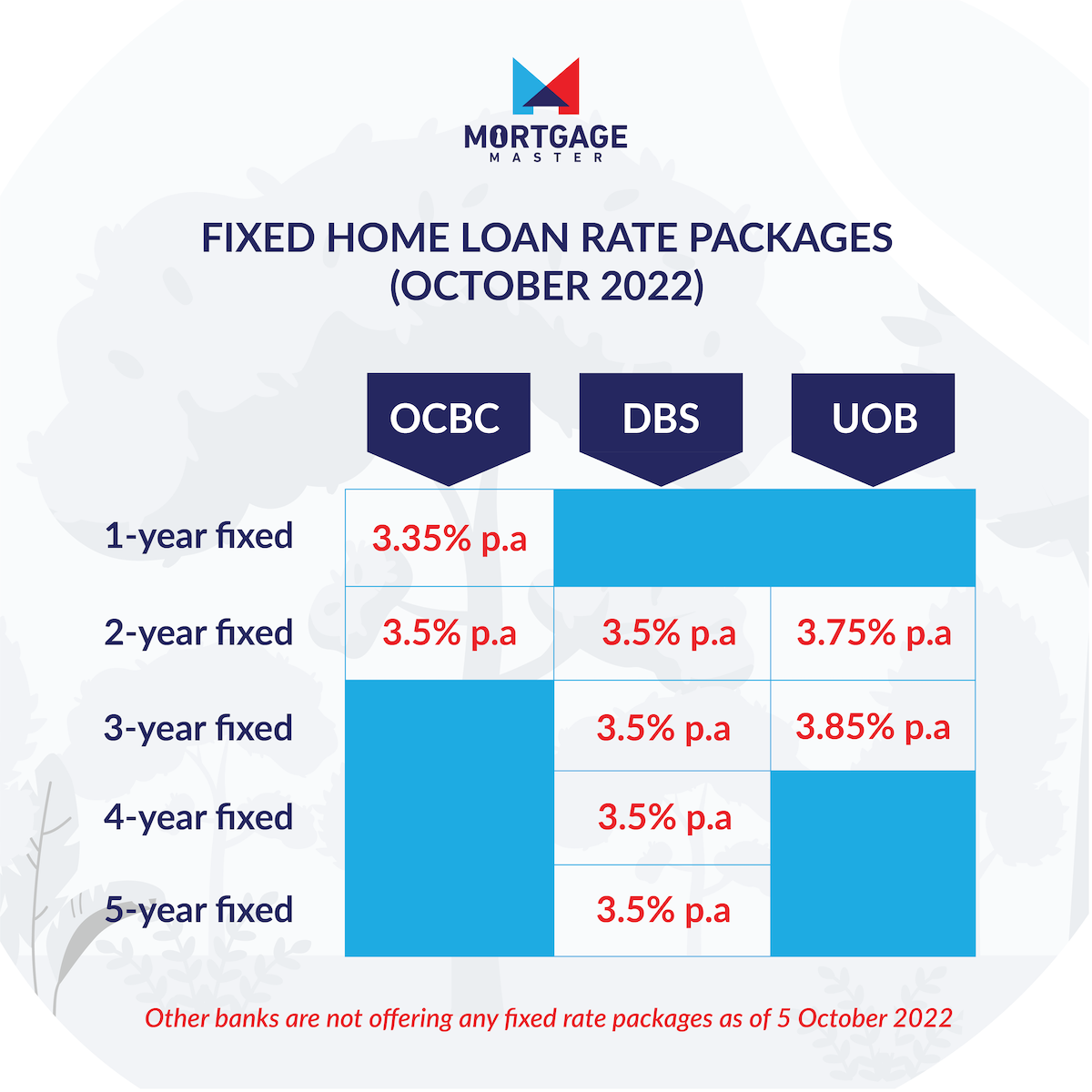

3.5 per cent and 3.85 per cent. Nope, these are not your next 4D numbers, but rather some of the latest fixed interest rate home loan packages from DBS, OCBC, UOB and HSBC.

For example, DBS is offering a flat 3.5 per cent fixed interest rate for lock-in periods of two to five years inclusive.

Wait, didn't the banks just adjust their fixed interest rate recently? Well, you are right to point that out.

Indeed, just more than a month ago, the banks adjusted rates on their fixed interest rate home loans. And yes, they are now doing it again. Let's explore three reasons why.

Given the world's reliance on US dollar as the reserve currency, any move that the US Federal Reserve (the Fed) makes will surely impact the rest of the world.

Right now, the Fed is having to suppress high levels of inflation in the US economy. And how is the Fed dealing with it? By increasing interest rates.

For context, the effective Federal Funds interest rate has jumped from 0.08 per cent in January 2022 to 3.08 per cent at the end of September 2022. Within the span of nine months, interest rates hiked at unprecedented speeds in recent memory.

Despite the rate hikes, inflation continues to remain persistently high. The Fed therefore believes it has no choice but to continue this rate hike to cool down the economy until inflation rate is back to an acceptable level of two per cent.

This has a rollover impact on the rest of the world's economy because almost every other Central Bank is following suit to raise their interest rates.

For those who aren't familiar with how banks work, here's a quick glimpse into the bank's business model.

The banks receives deposits from its customers like you and I. In return for the deposits, the bank offers a safe place to keep the cash and pays a small amount of interest rate to incentivise you to place your money with them.

[[nid:590217]]

The bank then utilises a part of these deposits that their customers have placed with them to finance its lending business. For instance, they lend the money to homeowners who are looking to finance their home purchase.

The bank then earns from the difference in interest rate, i.e. difference between what they offer in their savings account and what they are charging on mortgage loans.

In recent months, we have seen an upward rise in banks' cost of getting deposits from customers.

This is largely driven by the rising interest rate environment as the Fed fights against inflation. Because of this, the cost of fixed deposits is now close to the three per cent mark for a 12-month fixed deposit.

Since the cost of fixed deposit is rising, banks have no choice but to raise the interest rate on their home loan packages so that they can still earn a decent margin when they offer home loans.

When banks offer fixed rate home loans, banks are taking on some level of risks. That's because, if the fixed interest rate that they have set are eventually lower than the interest rates they are charging on their floating rate packages, then they lose out (or rugi in Bahasa Melayu).

That's right – banks may be customer-friendly, but they're still businesses at the end of the day.

[[nid:599229]]

That is why fixed interest rate home loan packages are typically priced higher than floating rate home loan packages. You're paying extra for the added security and reassurance, and banks are hedging their bets that home loan interest rates will never go higher than what they're charging you.

For example, those who took up home loans in October 2021 would be offered fixed rates packages that were as low as 1.5 per cent and floating rates that were even lower!

One year later, those on fixed rates are still enjoying 1.5 per cent, but those on floating rates will be paying about 2.25 per cent now. (Which is still better than what they'd be paying if they refinanced today!)

Thus, whenever the bank sets a fixed interest rate, they need to make sure that there is a healthy margin to avoid any scenario where they rugi.

Banks also don't want to be blindsided by having their fixed interest rate be set at a lower rate than their borrowing cost.

With interest rates expected to be on the rise, the defensive move that banks can take is to give themselves a greater margin of safety.

This is done by increasing the fixed interest rate on home loan packages such that there is a lower chance that banks will end up making a loss.

As a homeowner, there's not much you can do to change the minds of the Fed or the banks. However, there's something that you can do in your power, which is to keep your affordability in check.

The main concern for homeowners in a rising interest environment is that you may one day be no longer able to afford the monthly mortgage repayment for your home.

This is especially for homeowners who have been leveraging on a lot of cheap credit in the past decade.

To avoid this, one way is to consult a mortgage consultant before you commit to purchasing your next property.

A mortgage consultant will be able to advise you on what is the maximum limit of your loan quantum based on the current Total Debt Servicing Ratio (TDSR) regulations.

They will also be able to advice you whether you are affected by the recently announced property cooling measures. This is especially important if you have other debt obligations (e.g. car, children's education) to take care of.

The age old dilemma of many homeowners is back to haunt us again. As a homeowner, should you pick a fixed rate home loan over a floating rate one?

[[nid:598758]]

Remember our friends at the Fed? Based on their most recent meeting this past September, they've indicated that they expect interest rates to keep rising for at least two years, hitting a peak next year and only returning to where things are today in 2025.

Therefore, a two year fixed interest rate package is much more prudent than a one year fixed interest rate home loan package, but a three year package and beyond should only be taken up by those who prefer to pay a premium for the security.

Floating rate home loan packages are still an option, of course, and in the short run will still cost you less than a fixed rate package, but nothing short of a global recession (which is unfortunately still possible) would make it the better option over a fixed interest rate home loan over the next two years at least.

For existing homeowners, the rising interest rates is a good reminder for you to start taking your home loan seriously if you haven't done so.

If the last time you signed your home loan package was three to four years ago, it is very likely that you are paying a higher interest rate than what you will get if you were to refinance it.

This article was first published in Mortgage Master.