Bought an HDB flat between 1990 and 2017? Here's why you might face negative cash sales

This is a question that has come to the forefront of late.

For those looking to upgrade to a condo, there are two counterbalancing factors: higher resale flat prices seem to lower the risk of negative cash sales; but at the same time higher interest repayments might mean drawing on more CPF (and hence needing to refund a larger amount).

History is sometimes the best teacher, so we looked to the past to see when negative cash sales most tended to happen:

For all of the following, we assumed the worst-case scenario. That is, the maximum HDB loan*, coupled with maximum CPF usage (i.e., inclusive of the stamp duties, down payment, and monthly loan repayment).

Next, we assume that the buyer sells after five years. We are aware that prior to 2010, the MOP was different — but for simplicity, we'll keep our simulation to selling from the 5th year onwards.

Do note that scenarios depict an HDB loan of 90 per cent of the flat price, because loan curbs had not yet been implemented.

This was changed to 85 per cent after the December 2021 cooling measures, and for HDB flats purchased on or after 30th September 2022, the maximum loan is only 80 per cent.

In addition, you will see from the simulation that it matters when buyers made their sale or purchase along the property cycle.

As you might expect, buying during periods of high prices bring the highest risks of negative cash sales as it takes time for the property market to go to greater heights.

*In practice it's uncommon for anyone to get the maximum HDB loan, as you can only set aside up to $20,000 in your CPF when buying a flat; anything else must be used for the down payment. As such, most buyers pay more than the minimum down payment.

We looked at three-room, four-room, five-room, and Executive flats for these years since this is when data is available to us and it stops at 2017 as those who bought in 2018 would only reach their first MOP this year.

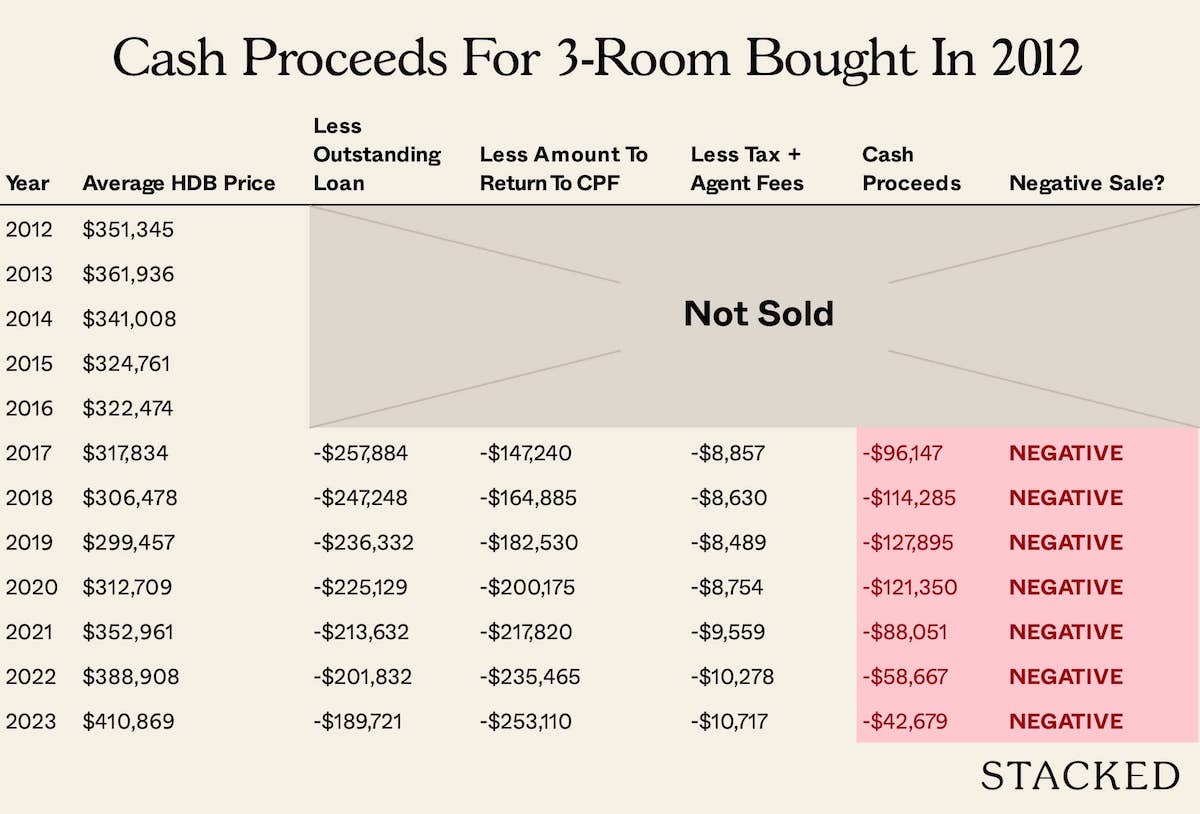

There were two 'problem spots' for three-room flats. These were from 1996 to 1997 (Asian Financial Crisis), and 2012 to 2013 (the last peak for resale flat prices, so they would have bought at a high price).

Here's what your cash on hand would look like if you had bought around 1996-1997 and sold in the subsequent years (negative cash leftover implies a negative cash sale).

If you had bought a 3-room flat in 2012:

The findings here will probably surprise no one: those who bought just before the Asian Financial Crisis would have to wait around 12 years to escape the risk of negative cash sales, while those who bought between 2011 to 2014 might still face negative cash sales today.

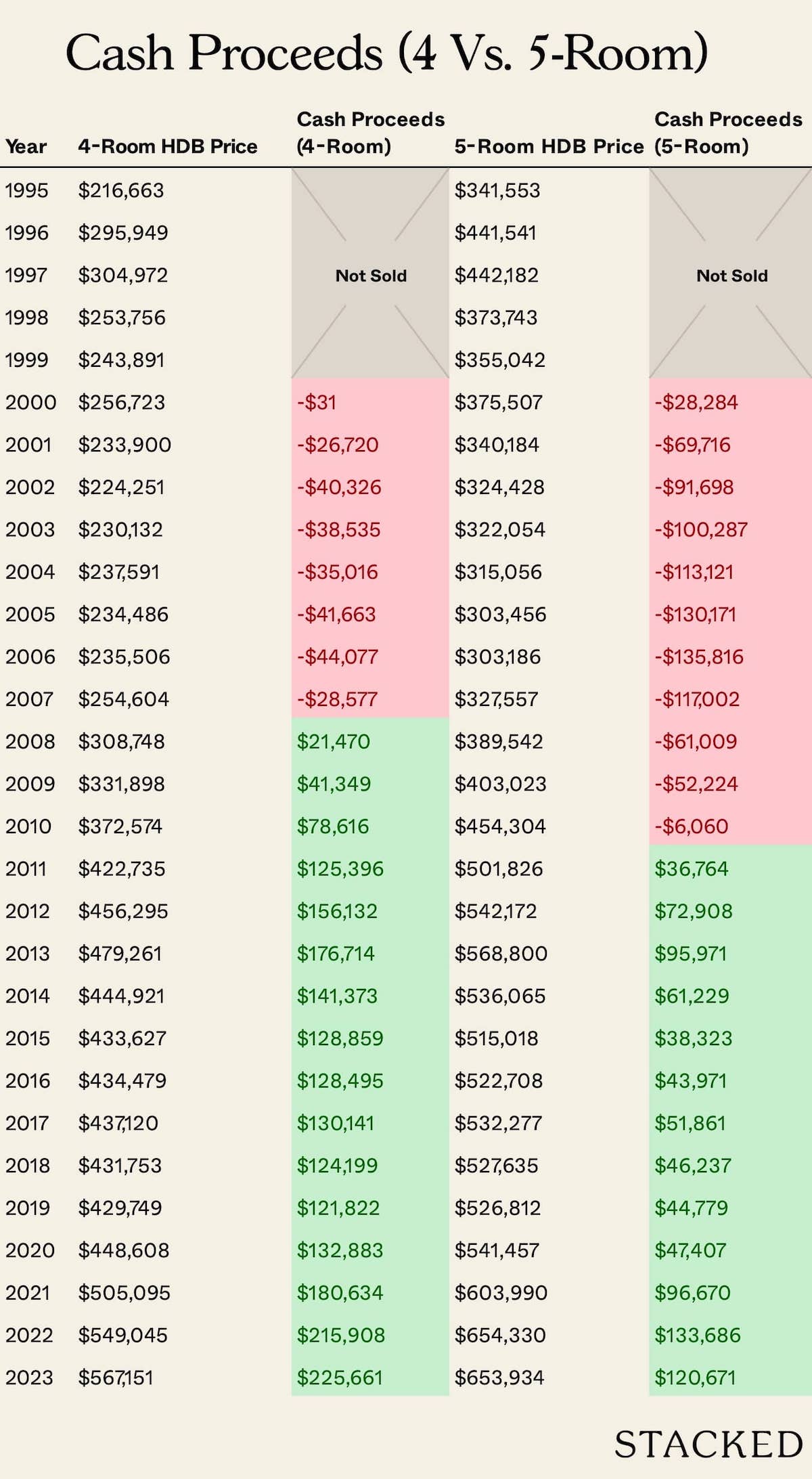

With regard to four-room flats bought in 1995, selling between 2000 to 2007 would have resulted in a negative cash sale. For those bought in 1996, selling between 2001 to 2010 would have resulted in a negative cash sale.

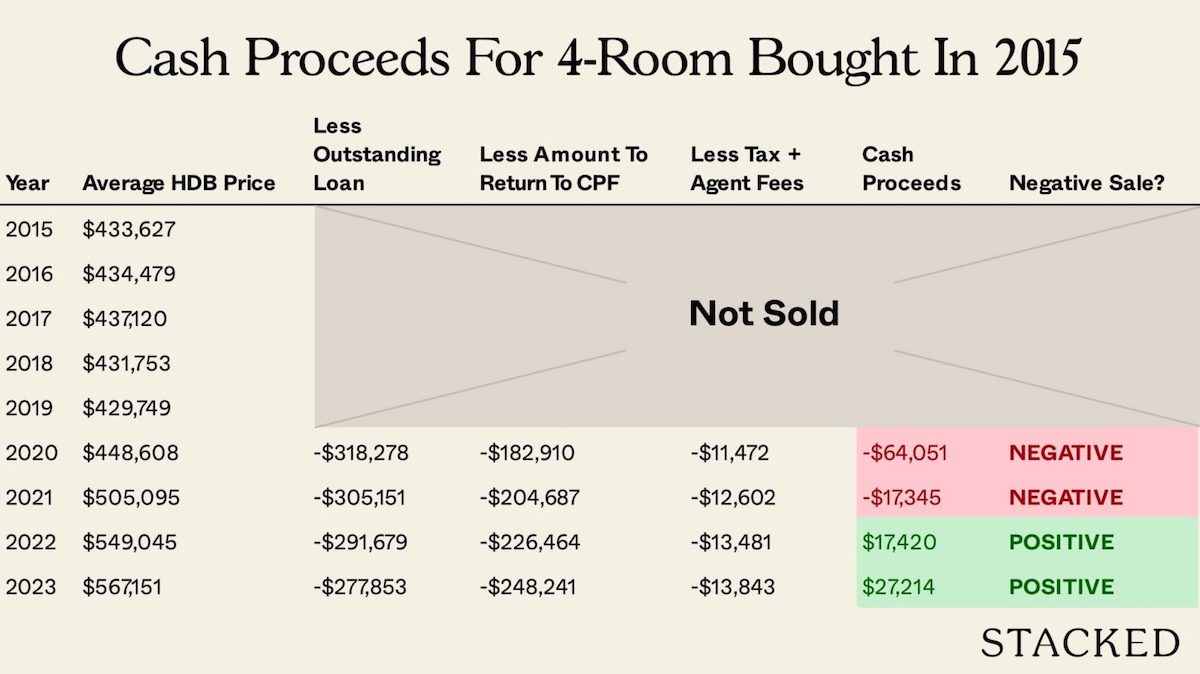

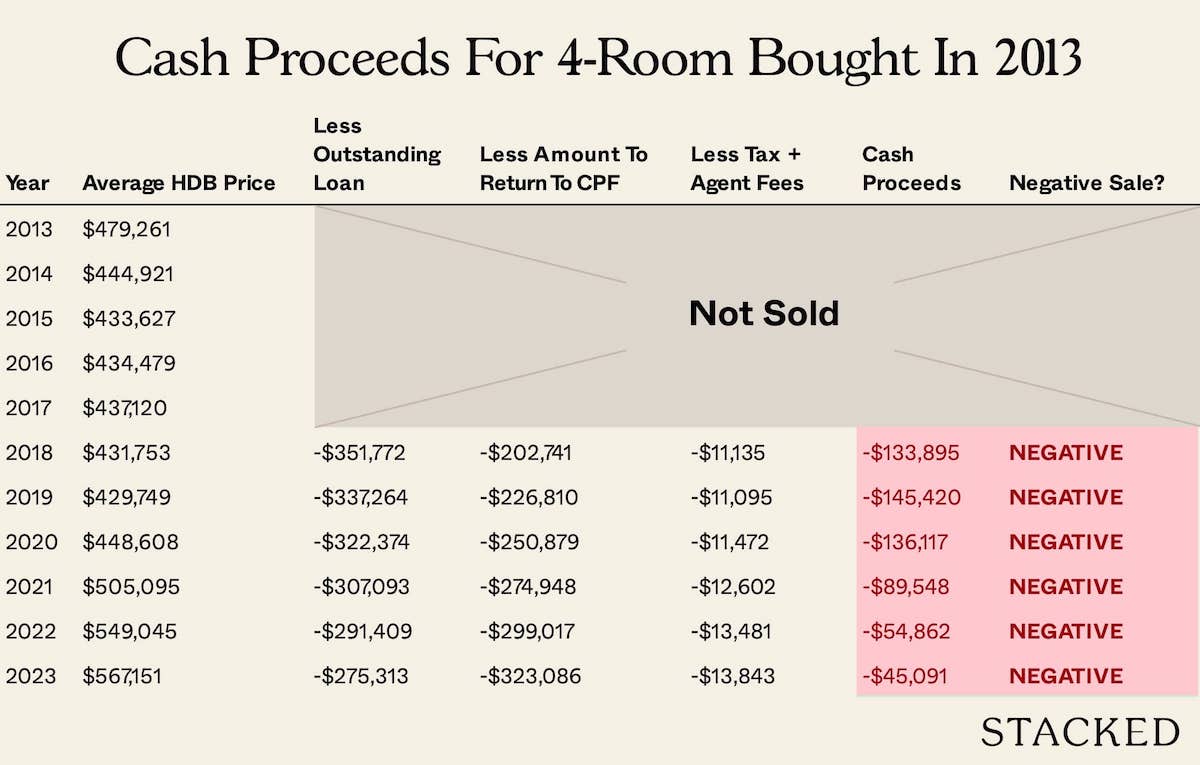

Buying between 2012 and 2017, there was potential for a negative cash sale for at least one of the years:

Most negative cash sales were due to the four-room flats appreciating too slowly, and the sale proceeds being less than what you'd need to refund into your CPF. Do note that the transactions were still profitable though.

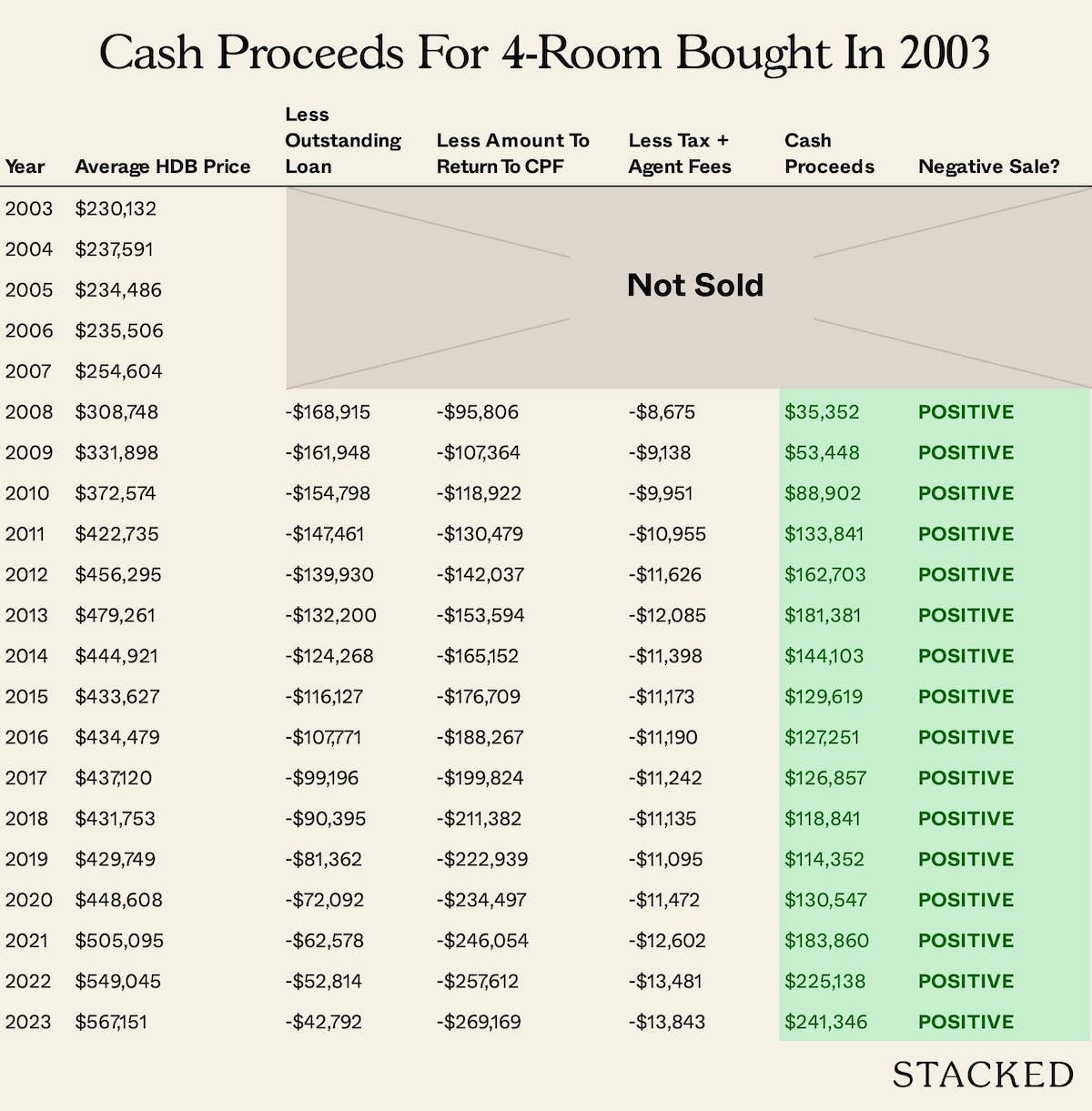

2003 to 2009 seems to have been the best period; if you had bought then and waited five years before selling, there would be no negative cash sales:

The most important finding could be that those who bought in 2012 or 2013, the last peak for flat prices, could still face negative cash sales despite the high prices today (although the risk steadily decreases as resale flat prices continue to increase).

Those who bought their flats in 2014 or later are at low risk of seeing negative cash sales this year.

Compared to four-room flats, there were longer periods in which buyers saw the risk of a negative cash sale. This is likely due to the higher overall prices of five-room flats, coupled with a lower rate of appreciation.

For example, four-room flats averaged $216,663 in 1995, while five-room flats averaged $341,533.

By 2022, four-room flats averaged $549,045, while five-room flats averaged $654,330.

Despite the large price gap between four-room and five-room flats, it is four-room units that show much higher appreciation; note that over this time period, four-room flats appreciated by around 153 per cent, while five-room flats appreciated by around 91 per cent.

Notice how the average prices in 1995 were so different from those in 1996?

To put into perspective, average five-room flat prices in 1996 costs almost 30 per cent more than a year ago!

Due to the Asian Financial Crisis, prices took a long time to recover. four-room flats also saw a sharp price increase, however due to the greater appreciation and lower quantum, buyers of both flats faced negative cash sales over very different periods.

Five-room flats bought in 1996 could see negative cash sales up until last year (2022), whereas a four-room counterpart would probably have stopped seeing negative cash sales from 2011 onward:

Those who experience negative cash sales for their five-room flats are thus likely to be those who bought prior to the Asian Financial Crisis, and who made heavy use of CPF for the down payment, servicing monthly loans, etc.

The same goes for those who bought on another 'bad' year in 2012 (the run-up to the last peak).

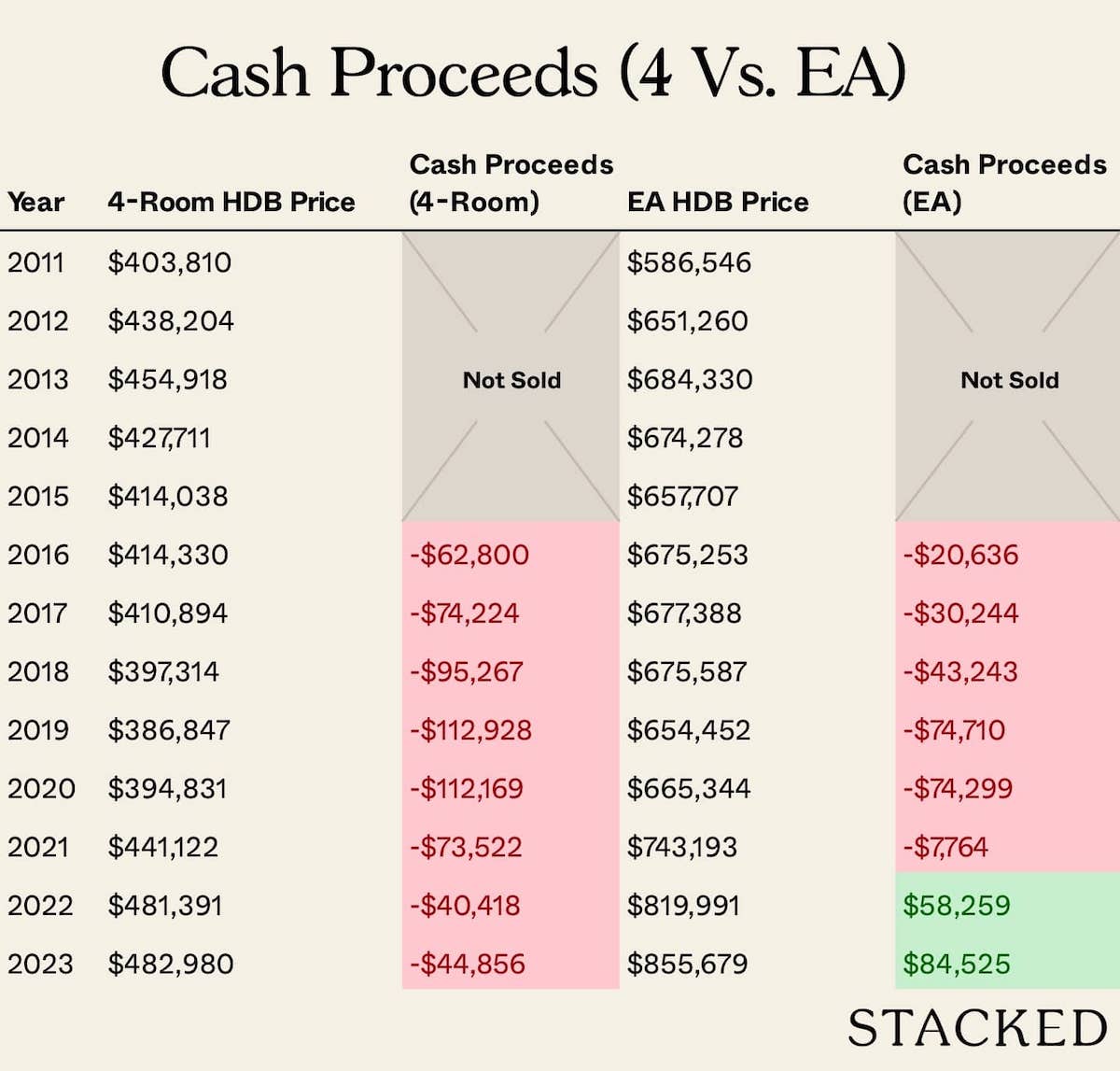

As with five-room flats, a high quantum is a problem. The average EA unit was around $572,772 in 1996. Buyers at this price, who maxed out on CPF usage, would still be facing negative cash sales today:

This can also be attributed to EA prices plummeting to an average of around $357,635 back in 2006, a rather large setback for those who bought in the previous decade.

Here, we examine the effects of lease decay, with regard to causing a negative cash sale. 'Older flats' here were limited to those with a built year of 1992 and earlier (meaning they're at least 30 years old by now!).

For this simulation, however, note that we have a lower transaction volume to work with, which could slightly skew the results.

Also, more of these flats are in mature estates such as Queenstown, Toa Payoh, etc., where demand and appreciation may work differently from other estates.

Like newer counterparts, older flats didn't escape the Asian Financial Crisis (1996 to 1997). However, things are slightly worse for them:

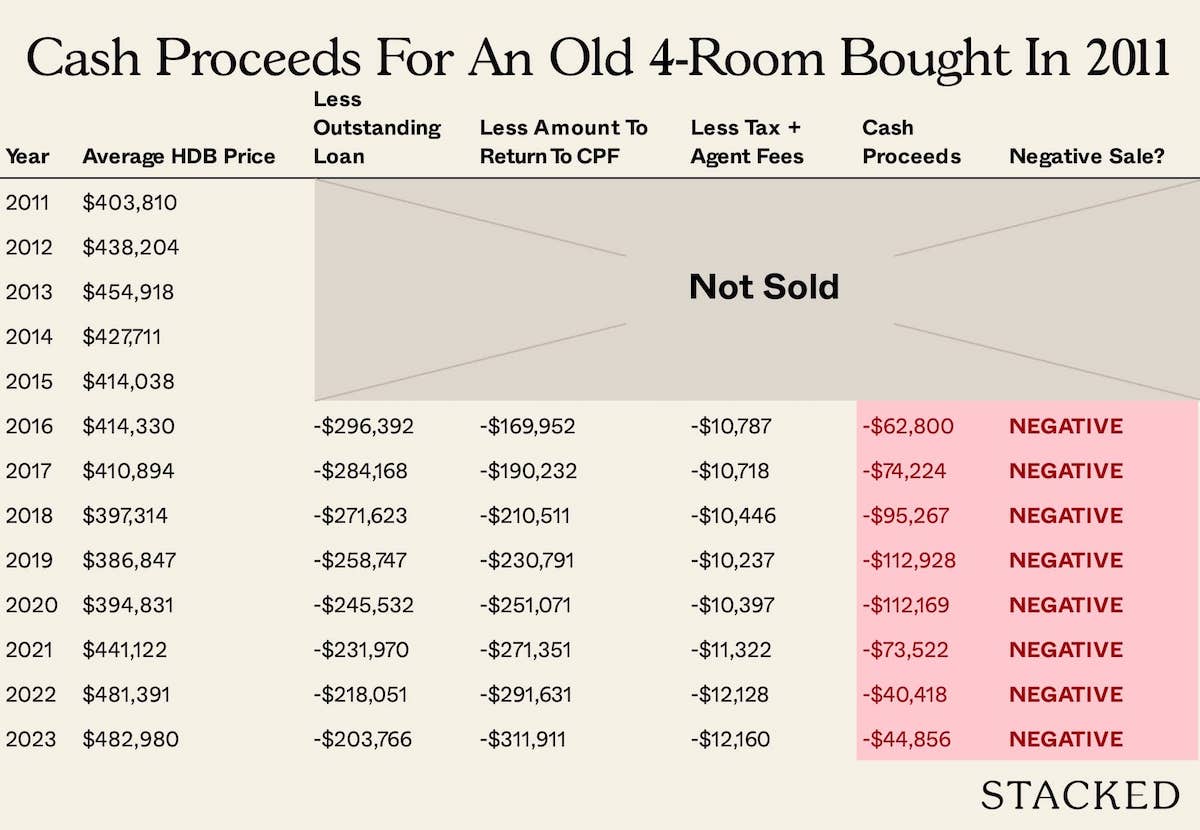

Like newer flats, negative sales were most probable in the stretch from 2002 to 2010. However, older flats would have experienced negative cash sales from 2016 to 2020 as well during the 'down' of the property market in that period.

This is not something that we saw with their newer counterparts.

2016 to 2020 saw declining flat prices, which began after measures like the MSR were introduced in 2013 to cool resale prices.

If the averages here are true, we might be seeing evidence that during such trough periods, prices of older flats are more adversely affected than newer counterparts.

For buyers from 2011 onward, the bad news is that many may still be in negative cash sale territory up till today. This may indicate that many older flats do not appreciate as well as newer ones:

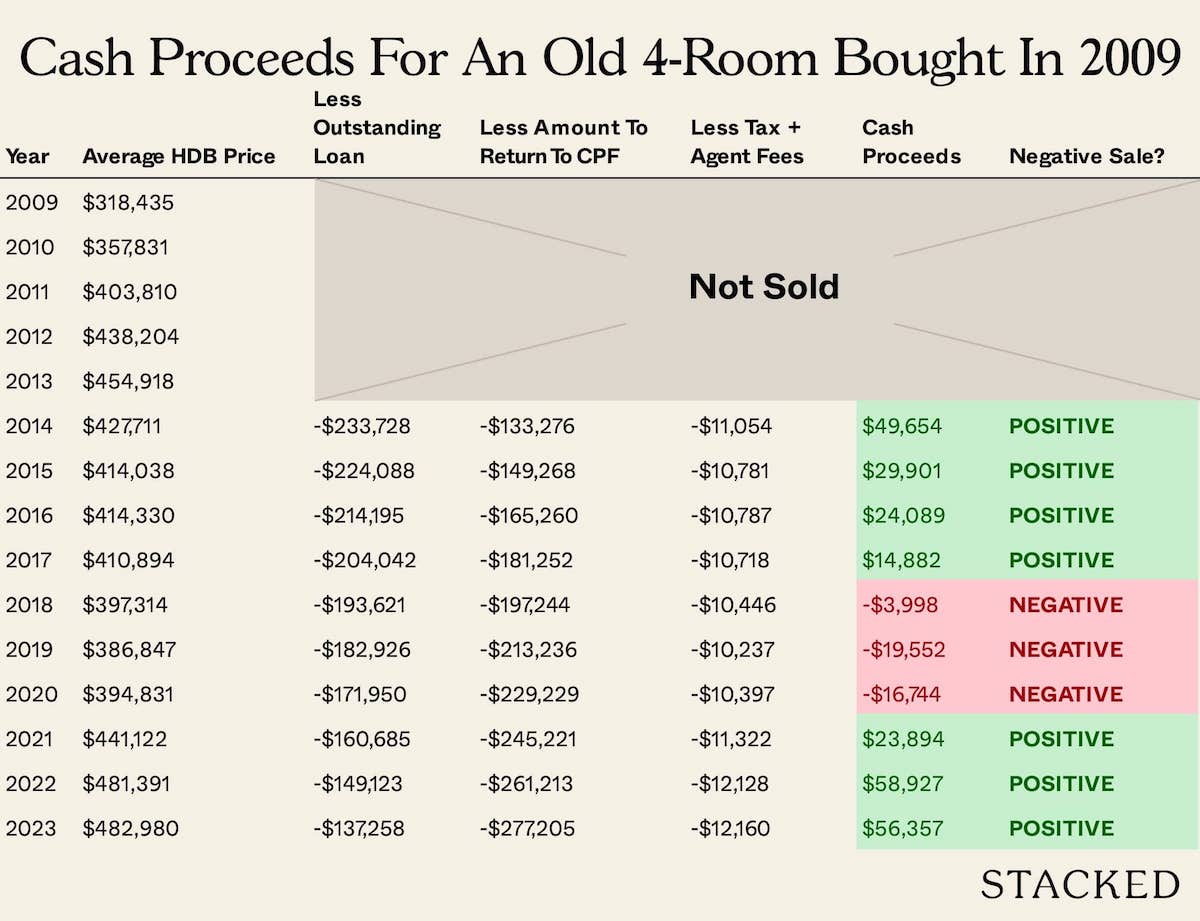

Also note that, for an older flat purchased in 2009, there were greater risks for a negative sale from 2018 to 2020; this was also absent in the simulation for newer flats:

Among older flats, larger units seem to have performed better. Those who bought an older five-room or EA unit, despite the higher quantum, are less likely to be in negative sale territory today, as compared to older four-room units.

For example: the average price for older four-room flats in 2011 was around $414,000. By 2022, the average was $481,000, which according to the simulation would place our flat in negative cash sale territory (around negative $40,000 after refund).

For EAs, prices in 2011 averaged $586,000. But in 2022, the average had risen to $820,000; an appreciation rate that took it well out of negative cash sale territory:

This may be due to a recent surge of interest in larger units, and buyers finding that the most affordable forms of large homes are older resale flats.

While appreciation is also a big factor, this is not something you have the ability to control.

What matters — and which you can decide — is the quantum.

In general, the more expensive your flat, the more CPF you use; hence the bigger your refund later since the absolute amount you pay in interest (both CPF accrued interest and HDB loan interest) is higher.

This may be a good argument in favour of getting a smaller resale flat, for those who want to upgrade in five years. The other alternative, of course, is just to use a mix of CPF and cash for your monthly loan repayments.

ALSO READ: We rushed to buy a home during the pandemic - here's why it nearly became a big regret

This article was first published in Stackedhomes.