Nearly all ECs resold in the past 15 years made a profit averaging $300k

4,263 or 99.9 per cent of the executive condominium (EC) units sold in the resale market between 2007 and end-August 2022 yielded an average gross profit of $295,904 each.

Most of these units were sold less than 10 years after they were first bought.

The findings were shared by OrangeTee & Tie in its latest Market Watcher Series report, which sampled the transactions of 4,266 ECs by matching the new sale and resale caveats of the same unit.

This shows the popularity of executive condos, which are a hybrid form of public and private housing in Singapore.

While new ECs come with government subsidies, they are sold by private developers and come with the same range of facilities found in private properties.

After the five-year Minimum Occupation Period (MOP), ECs can be resold to PRs. The pool of buyers is further widened after 10 years of their Temporary Occupation Period (TOP), as foreigners are allowed to buy them.

Besides the average profit of $300,000 for each unit, here are a few findings that caught our eye.

Among the ECs sold in the resale market in the last 15 years, 294 units yielded a gross profit of at least $500,000 each.

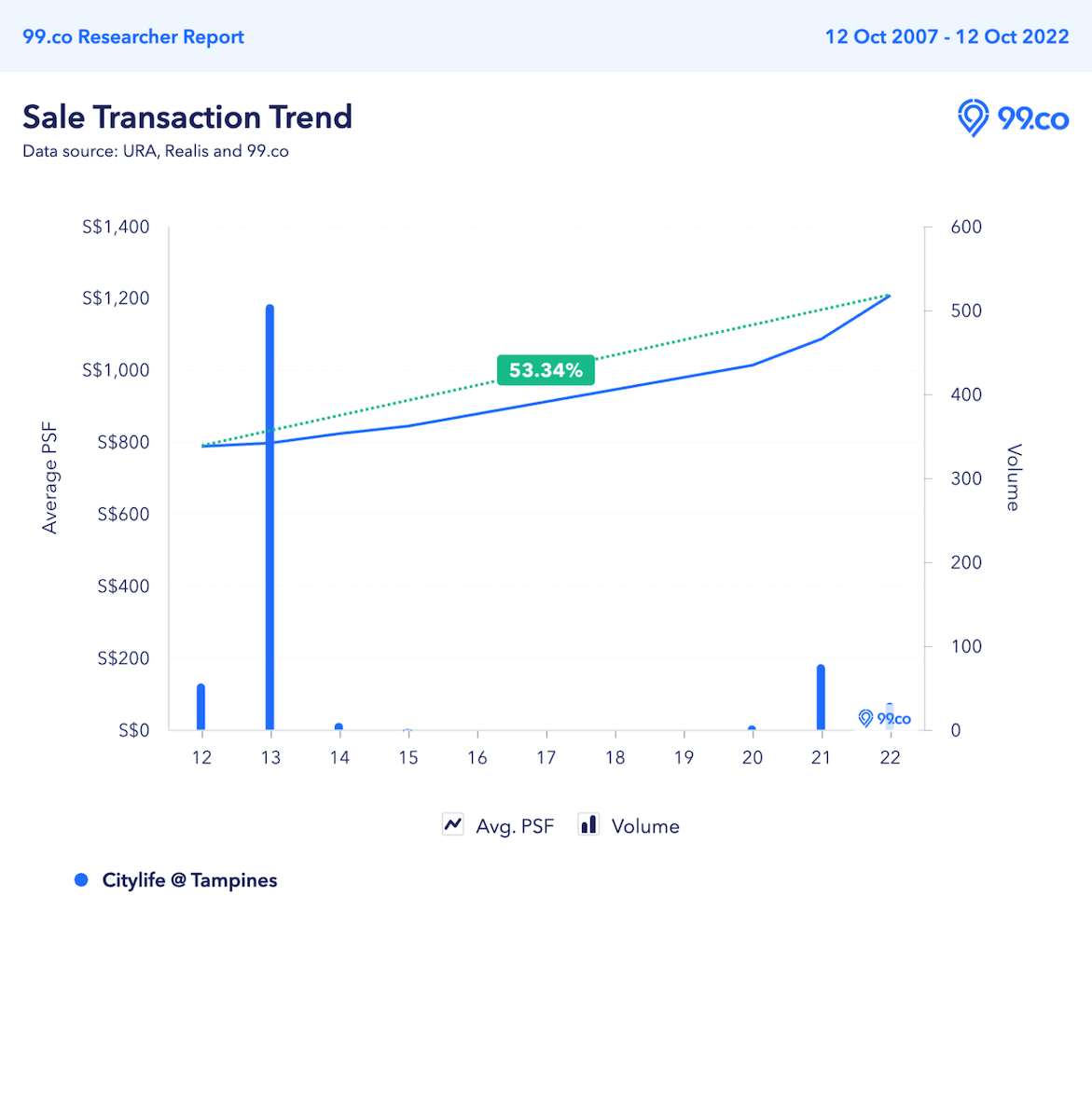

This included the $3.29 million resale transaction in 2021 for a unit at CityLife@Tampines, yielding the highest profit among the ECs sampled at $1.38 million. With the unit first bought in 2013 for $1.91 million, the holding period was 8.6 years.

Since the project's launch in 2012, the EC has seen a price appreciation of 53.34 per cent. The project hit TOP in 2016 and has since finished its MOP.

Nevertheless, the highest proportion of the ECs resold (34 per cent) made a gain ranging from $200,000 to less than $300,000.

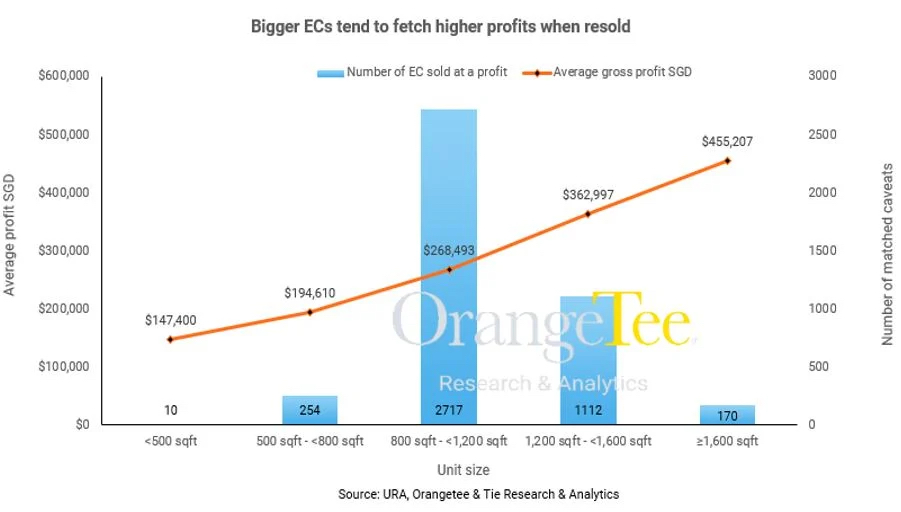

Perhaps due to the increasing demand for bigger space, larger ECs tend to make the highest profit.

The graph below also shows that as unit size increases, the average profit goes up.

Among the ECs sampled, 170 units that spans at least 1,600 square feet (sq ft) had profits averaging $455,207.

This includes the most profitable EC transaction mentioned above, in which the unit spans 3,864 sq ft. This works out to a price per square feet (psf) of $851 – a 72 per cent increase from the $495 psf when it was first bought.

Interestingly, among the top 10 most profitable EC units with a holding period of less than 10 years, half came from [email protected], with unit sizes ranging from 2,691 to 3,864 sq ft.

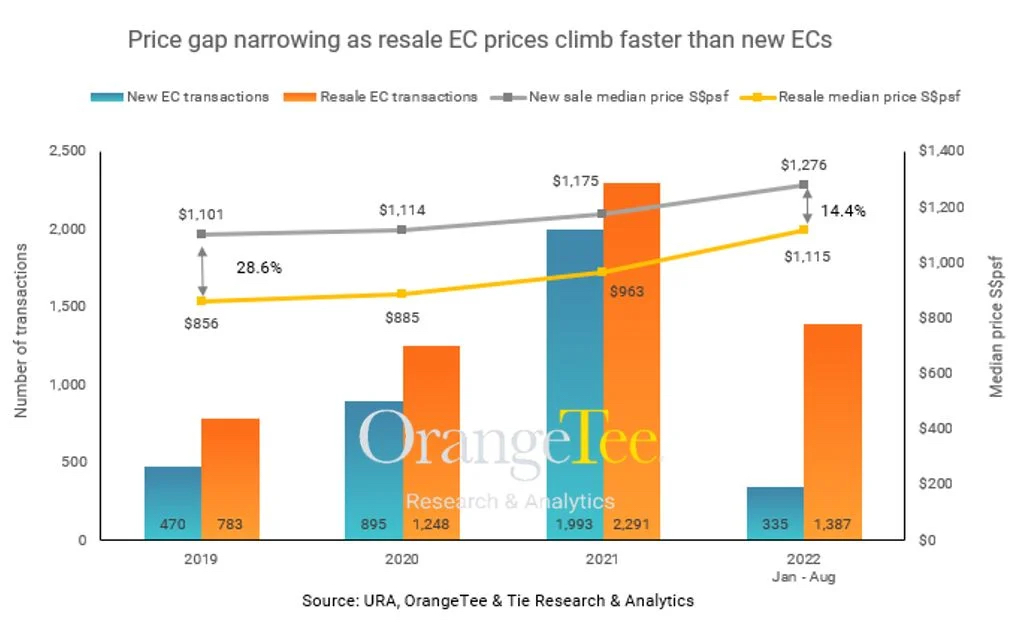

The report also shared that the median price of resale ECs have been rising faster than new ECs. Between 2019 and the first eight months of 2022, prices of resale ECs have grown by 30.3 per cent from $856 psf to $1,115 psf.

In the same period, prices of new ECs have risen by 15.9 per cent from $1,101 psf to $1,276 psf. This led to a narrower price gap, from 28.6 per cent in 2019 to 14.4 per cent in the first eight months of this year.

Upcoming ECs to be launched this year include Copen Grand at Tengah and Tenet at Tampines.

Launched for e-application on Oct 7, Copen Grand will also be Tengah's first EC, with prices starting at $1.08 million ($1,338 psf) for a two-bedroom plus study.

ALSO READ: HDB resale prices continue to climb in September; record 45 million-dollar flats sold