We make $220k per year and our executive condo just reached MOP - is it the right time to sell now to move?

I'm kinda stuck in dilemma right now, whether I should sell my EC (Brownstone) which just attained the Minimum Occupancy Period (MOP) or stay with it until the market stabilises (hopefully) in the near future. We are afraid that we would catch a falling knife at this juncture.

My considerations are:

1. A space that is suitable for myself, wife, two-year-old son and a helper. We are planning for a second kid as well. This would mean that a three-bedder premium with a utility is the minimum.

2. Preferably an area with good primary schools within 1km

3. Preferably within 15-20mins drive to our parents at Bishan

4. Our combined annual income is around 220k.

My unit at Brownstone is a Three-Bedder Premium, 990 sq ft.

| Description* | Amount |

|---|---|

| Assumed sale price of Brownstone | $1,200,000 |

| Available funds for the next purchase | $700,500 |

| Monthly salary (Husband) | $14,000 |

| Monthly salary (Wife) | $3,600 |

| Monthly expenses (Total) | $9,500 |

| Description | Amount |

|---|---|

| Assumed sale price of Brownstone | $1,200,000 |

| Less: Outstanding mortgage | $555,000 |

| Less: Lawyer fees | $2,500 |

| Less: Agent fees | $12,000 |

| HDB grant | $30,000 |

| Proceeds | $600,500 |

| Description* | Amount |

|---|---|

| Accrued CPF | $271,000 |

| Cash from proceeds (less accrued CPF) | $329,500 |

| Additional cash on hand | $50,000 |

| Additional CPF | $50,000 |

| Available funds for next purchase (Cash) | $379,500 |

| Available funds for next purchase (CPF) | $321,000 |

| Total | $700,500 |

| Monthly financial breakdown | Amount |

|---|---|

| Salary (Husband) | $14,000 |

| Salary (Wife) | $3,600 |

| Total | $17,600 |

| Less: Combined credit card spending | $5,000 |

| Less: Car loan | $1,300 |

| Less: Childcare | $1,200 |

| Less: Utilities | $500 |

| Less: Helper cost | $1,500 |

Looking forward to some good advice!

We're always happy to hear how our content has been useful, and it's great how you've detailed everything out for us.

It's a timely question that you are asking, and no doubt many other homeowners are likely facing the same dilemma as you are. It seems to be the best time to sell right now, when prices are at a high. But at the same time, if you only have one house, you will be buying at a high as well.

For sure, it's enticing to be able to unlock your profits right now, especially if you are thinking that the market may turn at any moment.

First, let's start by taking a look at how your current property at The Brownstone is faring.

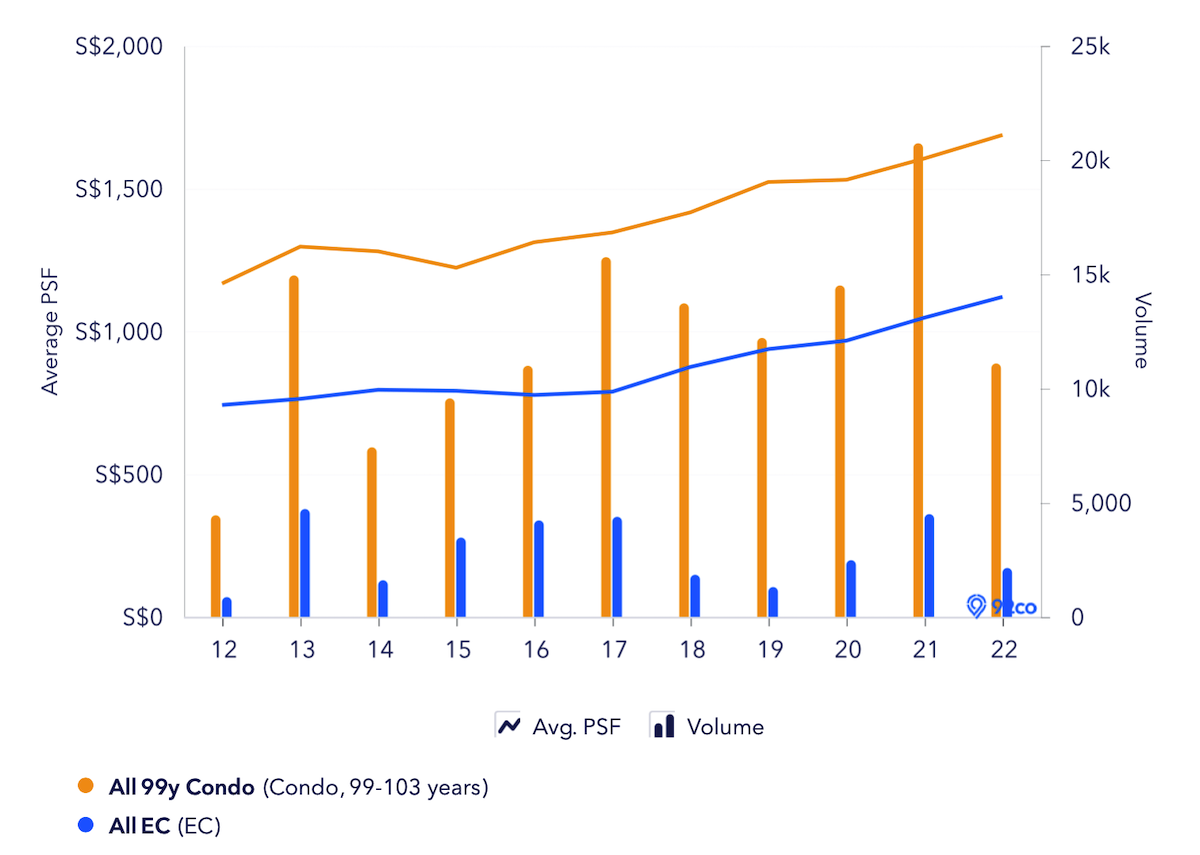

This is how EC prices have been faring overall, as compared to other leasehold condo prices.

Looking at the whole of Singapore, overall EC prices have been moving in tandem with private condominiums but there is still a defined gap in prices.

However, in District 27, EC prices are gradually catching up with the prices of private condominiums. As of 2022, the average psf of a 99-year condo is $1,243 while the average psf of an EC is $1,189, which translates to a difference of only 4.5 per cent.

In fact, from the graph above, you'll notice that in 2020, the average psf of ECs exceeded that of 99-year private condominiums. This is due to the launch of Parc Canberra which pushed up the average PSF of ECs to $1,042 and at the same time, there was a considerable number of transactions for older 99-year private condominiums which brought down the average psf to $956.

One possible explanation as to why the price gap between ECs and 99-year private developments in District 27 is narrowing is that there are a handful of older projects in District 27 which is bringing down the average PSF of the private condominiums.

This is a list of all the developments in District 27:

| Project | TOP year | Tenure | Development type | No. of units | Avg psf (last 12 months) |

|---|---|---|---|---|---|

| 1 Canberra | 2015 | 99 years from 2012 | EC | 665 | $1,025 |

| Canberra Residences | 2013 | 99 years from 2010 | Condominium | 320 | $972 |

| D’Banyan | 2005 | 999 years from 1885 | Apartment | 18 | $938 |

| Eight Courtyards | 2014 | 99 years from 2010 | Condominium | 654 | $1,118 |

| Euphony Gardens | 2001 | 99 years from 1998 | Condominium | 304 | $783 |

| Goodlink Park | 1989 | Freehold | Condominium & Landed | 6 Condo, 24 Landed | $311 |

| Kandis Residence | 2021 | 99 years from 2016 | Condominium | 130 | $1,505 |

| Lilydale | 2003 | 99 years from 2000 | EC | 318 | $775 |

| Nine Residences | 2015 | 99 years from 2013 | Apartment | 186 | $1,168 |

| North Gaia | U/C | 99 years | EC | 617 | $1,296 |

| North Park Residences | 2018 | 99 years from 2015 | Apartment | 920 | $1,636 |

| Northwood | 2009 | Freehold | Condominium | 140 | $1,112 |

| Orchid Park Condominium | 1994 | 99 years from 1991 | Condominium | 615 | $855 |

| Parc Canberra | U/C | 99 years | EC | 496 | $1,083 |

| Parc Life | 2018 | 99 years from 2014 | EC | 628 | $1,064 |

| Platina Gardens | 1987 | Freehold | Condominium & Landed | 7 Condos, 21 Landed | $730 |

| Provence Residence | U/C | 99 years | EC | 413 | $1,227 |

| Seletaris | 2001 | Freehold | Condominium | 328 | $1,024 |

| Sembawang Cottage | 1997 | Freehold | Apartment | 20 | $475 |

| Signature at Yishun | 2017 | 99 years from 2014 | EC | 525 | $1,088 |

| Skies Miltonia | 2016 | 99 years from 2012 | Condominium | 420 | $1,110 |

| Skypark Residences | 2016 | 99 years from 2013 | EC | 506 | $1,140 |

| Sun Plaza | 2000 | 99 years from 1996 | Apartment | 76 | $786 |

| Symphony Suites | 2018 | 99 years from 2014 | Condominium | 660 | $1,173 |

| The Brownstone | 2017 | 99 years from 2014 | EC | 638 | $1,078 |

| The Canopy | 2014 | 99 years from 2010 | EC | 406 | $900 |

| The Commodore | U/C | 99 years | Condominium | 219 | $1,508 |

| The Criterion | 2018 | 99 years from 2014 | EC | 505 | $1,037 |

| The Estuary | 2013 | 99 years from 2008 | Condominium | 608 | $1,069 |

| The Miltonia Residences | 2014 | 99 years from 2010 | Condominium | 410 | $1,008 |

| The Nautical | 2015 | 99 years from 2011 | Condominium | 435 | $1,097 |

| The Sensoria | 2007 | Freehold | Condominium | 73 | $1,011 |

| The Visionaire | 2018 | 99 years from 2015 | EC | 632 | $1,083 |

| The Watergardens At Canberra | U/C | 99 years from 2020 | Condominium | 448 | $1,443 |

| The Wisteria | 2018 | 99 years from 2015 | Apartment | 216 | $1,248 |

| Yishun Emerald | 2002 | 99 years from 1998 | Condominium | 436 | $852 |

| Yishun Sapphire | 2001 | 99 years from 1998 | Condominium | 380 | $844 |

Source: Edgeprop

And so we can see from the list above that a third of all the projects in District 27 are made up of ECs which are mostly completed from 2014 onwards except for Lilydale which has already been privatised. This means the oldest EC is only 8 years old, which is still very new, all things considered.

On the other hand, out of all the private condominiums in District 27, 36per cent are built in 2002 and earlier, which means a little over a third of these projects are 20 years and older. You can see from the table above that these older developments are mostly transacting at lower than $1,000 psf with the exception of Seletaris.

Naturally, buyers tend to steer towards newer projects so prices of these developments tend to be higher.

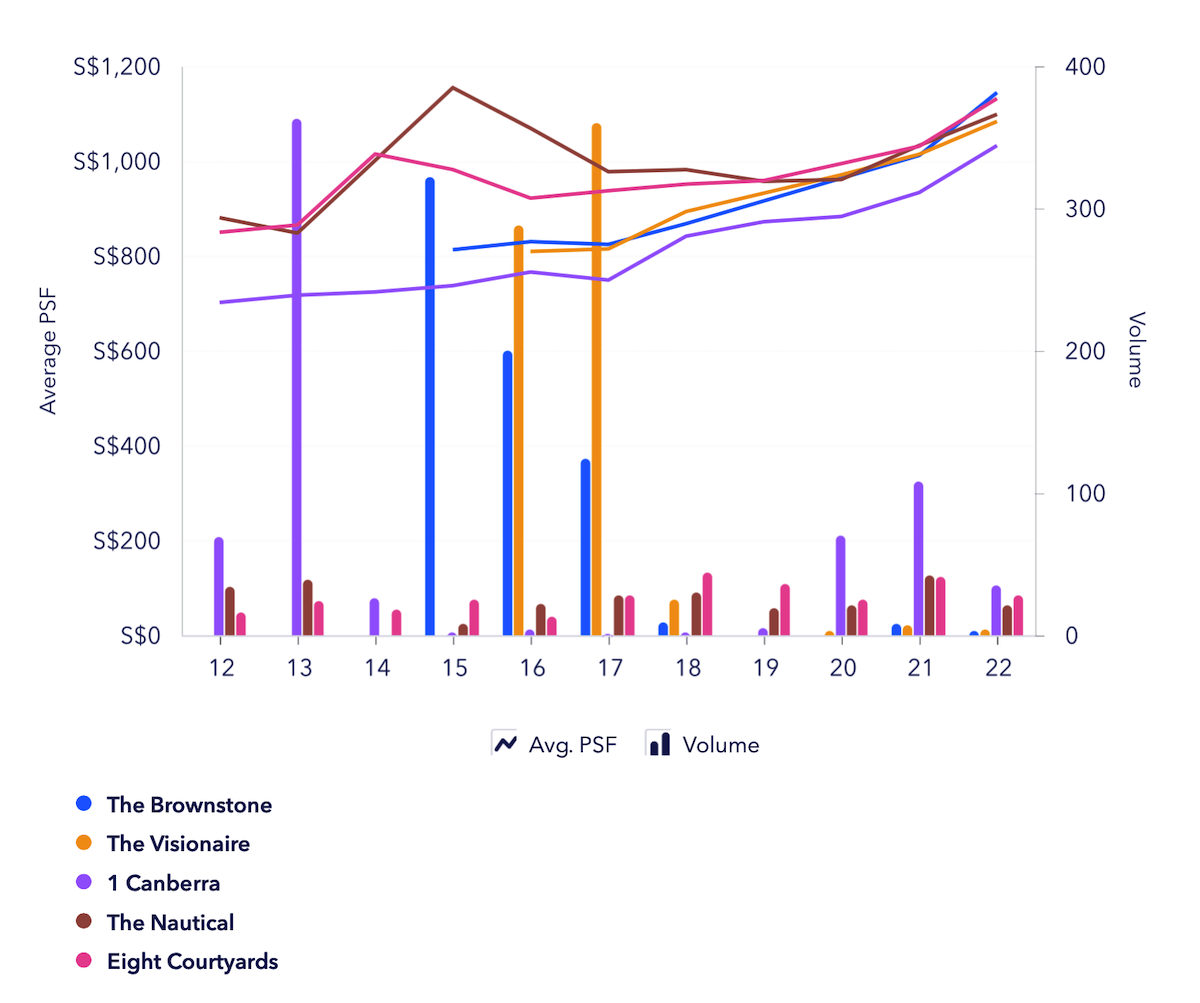

Now, let's now take a look at how The Brownstone is performing in comparison with some of the newer developments in the vicinity.

| Project | TOP year | Tenure | Development type |

|---|---|---|---|

| Eight Courtyards | 2014 | 99 years from 2010 | Condominium |

| 1 Canberra | 2015 | 99 years from 2012 | EC |

| The Nautical | 2015 | 99 years from 2011 | Condominium |

| The Brownstone | 2017 | 99 years | EC |

| The Visionaire | 2018 | 99 years from 2015 | EC |

Source: Edgeprop

Looking at the graph above, we can see that currently The Brownstone’s average PSF has exceeded that of the two condominiums, Eight Courtyards, and The Nautical.

However, The Brownstone has just obtained its MOP this year and there have only been three transactions in the last nine months. That said, The Visionaire has yet to meet its MOP, so it may not be the fairest comparison.

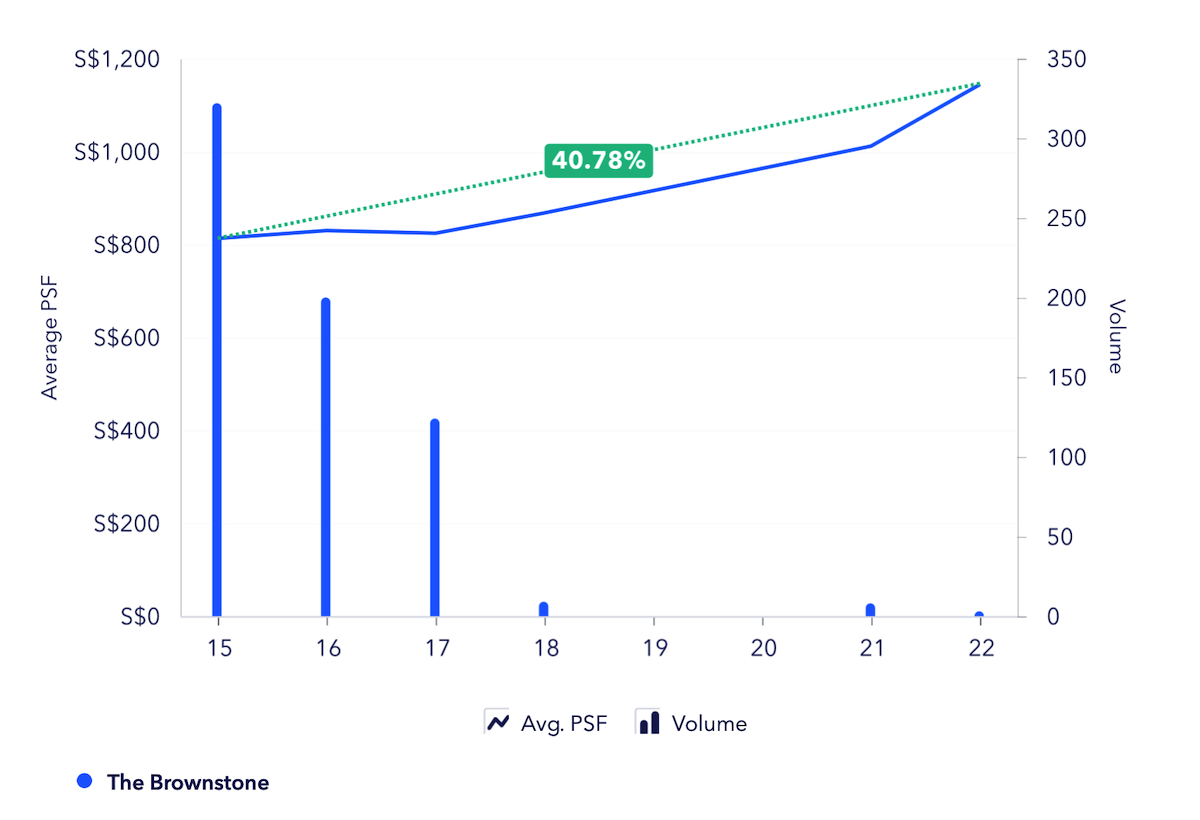

Since its launch, the average psf of The Brownstone has gone up by 40.78 per cent.

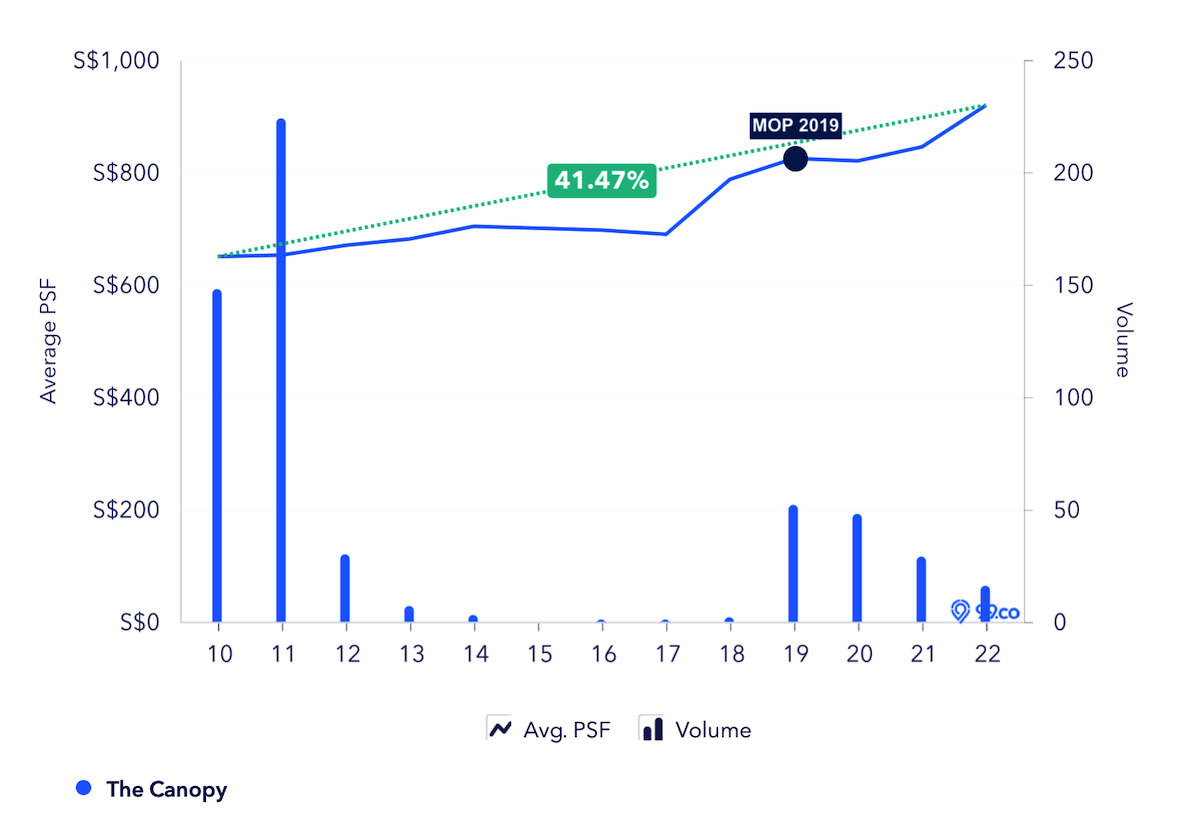

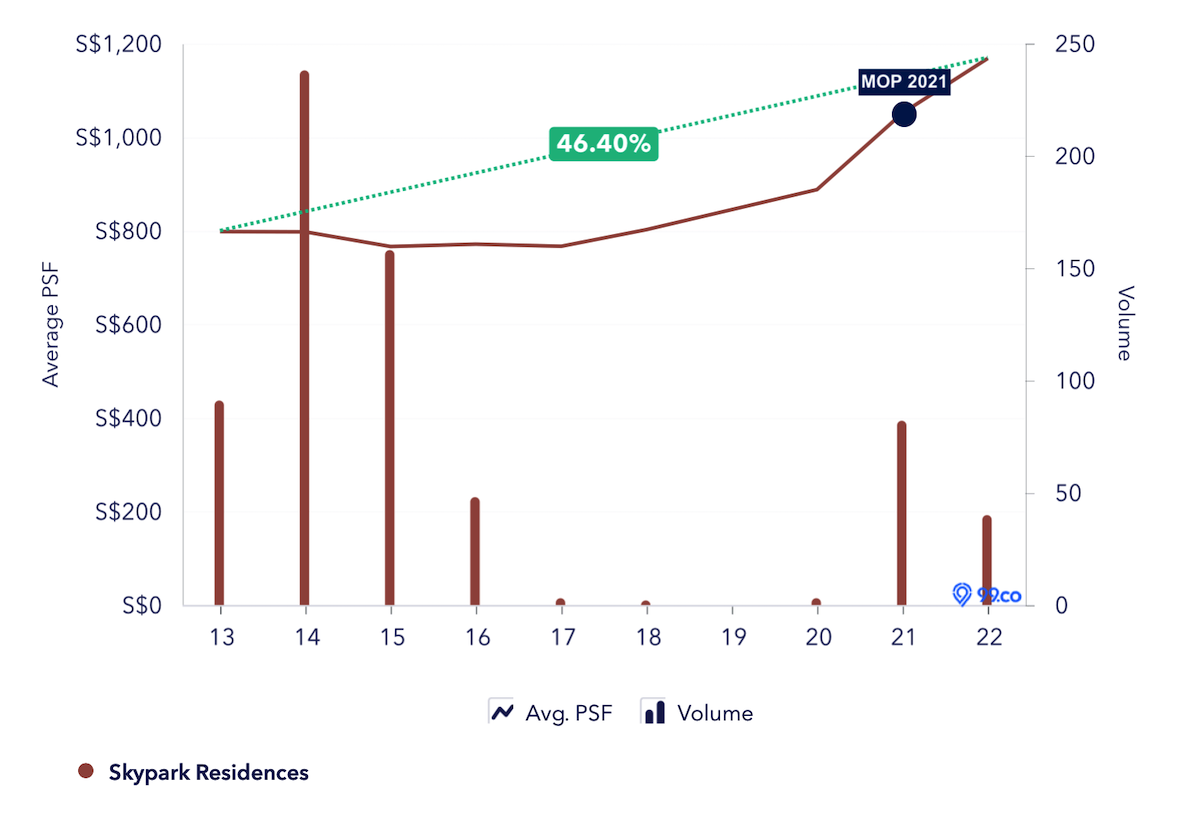

Let’s look at how other ECs in District 27 are faring:

| Project | TOP year | Tenure | Development Type |

|---|---|---|---|

| Lilydale | 2003 | 99 years from 2000 | EC |

| The Canopy | 2014 | 99 years from 2010 | EC |

| 1 Canberra | 2015 | 99 years from 2012 | EC |

| Skypark Residences | 2016 | 99 years from 2013 | EC |

| Signature at Yishun | 2017 | 99 years from 2014 | EC |

Source: Edgeprop

Excluding Lilydale, the prices of the other four younger ECs have appreciated by an average of 44.38 per cent since their launch, so The Brownstone isn't too far off.

We can see from the graphs above that prices of the developments continued on an uptrend even after they hit their MOP so going by that, it's entirely plausible at this point that there is still room for growth for The Brownstone.

Looking at the trend line for Lilydale, its prices peaked in 2013 which was the year it hit its 10-year mark and became privatised. However, we must also be cognisant that it may not be the best example given that the timeline coincides with when the overall market was picking up from 2010 to 2013.

Ultimately, what you are probably interested to find out is whether it's the right time to sell, or if you should hold out for longer. Here's how holding onto an EC for longer typically plays out.

Do note that this is, of course, just a general overview, and we aren't accounting for any other external factors here that may have an effect on the performance.

This graph shows the price movement for ECs that obtained their TOP in the year 2005. We can see that in the fifth year when they reached their MOP, prices appreciated by 53.92 per cent, and on the tenth year mark, it has gone up by 84.51 per cent.

Having said that, it may not be the most conclusive as there were only two projects that obtained their TOP in 2005, namely Whitewater and The Esparis.

While we can't predict the future, we have taken a look at an ECs historical performances and have seen that generally, ECs tend to perform better if held until full privatisation at the 10-year mark.

As the saying goes, time in the market beats timing the market. We have actually previously written about this, you can read more here.

| Description | Amount |

|---|---|

| Maximum loan based on assumed ages of 38 and a combined income of $17,600 with a monthly car loan of $1300 | $1,658,722 (27 years tenure) |

| Monthly repayment at four per cent interest | $8,380 |

| CPF funds ($321,000 refund + $30,000 CPF Grants + $50,000) | $401,000 |

| Cash ($329,500 proceeds + $50,000) | $379,000 |

| Total loan + CPF funds + cash | $2,438,722 |

| BSD based on $2,438,722 | $82,149 |

| Estimated affordability | $2,356,573 |

| Description | Amount |

|---|---|

| Combined credit card spending | $5,000 |

| Car loan | $1,300 |

| Childcare | $1,200 |

| Utilities | $500 |

| Helper cost | $1,500 |

| Total monthly expenses | $9,500 |

With a monthly combined income of $17,600, let's say you were to save $2,000/month, after deducting your expenses, you'll be left with $6,100 to pay for the mortgage. Based on a monthly repayment of $6,100, four per cent interest, and 27 years tenure, your maximum loan will be $1.2 million.

| Description | Amount |

|---|---|

| Maximum loan | $1,200,000 (27 years tenure) |

| Monthly repayment at four per cent interest | $6,062 |

| CPF funds ($321,000 refund + $30,000 CPF Grants + $50,000) | $401,000 |

| Cash ($329,500 proceeds + $50,000) | $379,000 |

| Total loan + CPF funds + cash | $1,980,000 |

| BSD based on $1,980,000 | $63,800 |

| Estimated affordability | $1,916,200 |

Seeing that your son is currently two years old and with plans for a second child, you'll most likely stay in the next property until both of them finish primary school which will be in 10 to 12 years' time.

Since you are planning to stay for a relatively long term, of course looking for a freehold or very new leasehold development would be ideal. Given the budget though, we will just be looking at newer leasehold projects.

As we don't know the genders, for now, we will just be looking at developments that are close to co-ed primary schools. The following are some projects that fit your requirements and fall within the $1.9 million budget.

Note that this is not an exhaustive list, but some that we have found which are close to popular schools and do meet your budget. For that an exhaustive list and a more in-depth analysis of such projects, we will suggest you consult with an agent to further analyse if they are indeed suitable for your family.

The Garden Residences is a 99-year leasehold development that just obtained its TOP in 2021. It's made up of 613 units spread across five towers consisting of one to five bedroom types. The project is within 1km of Rosyth School and under 15 minutes drive to Bishan.

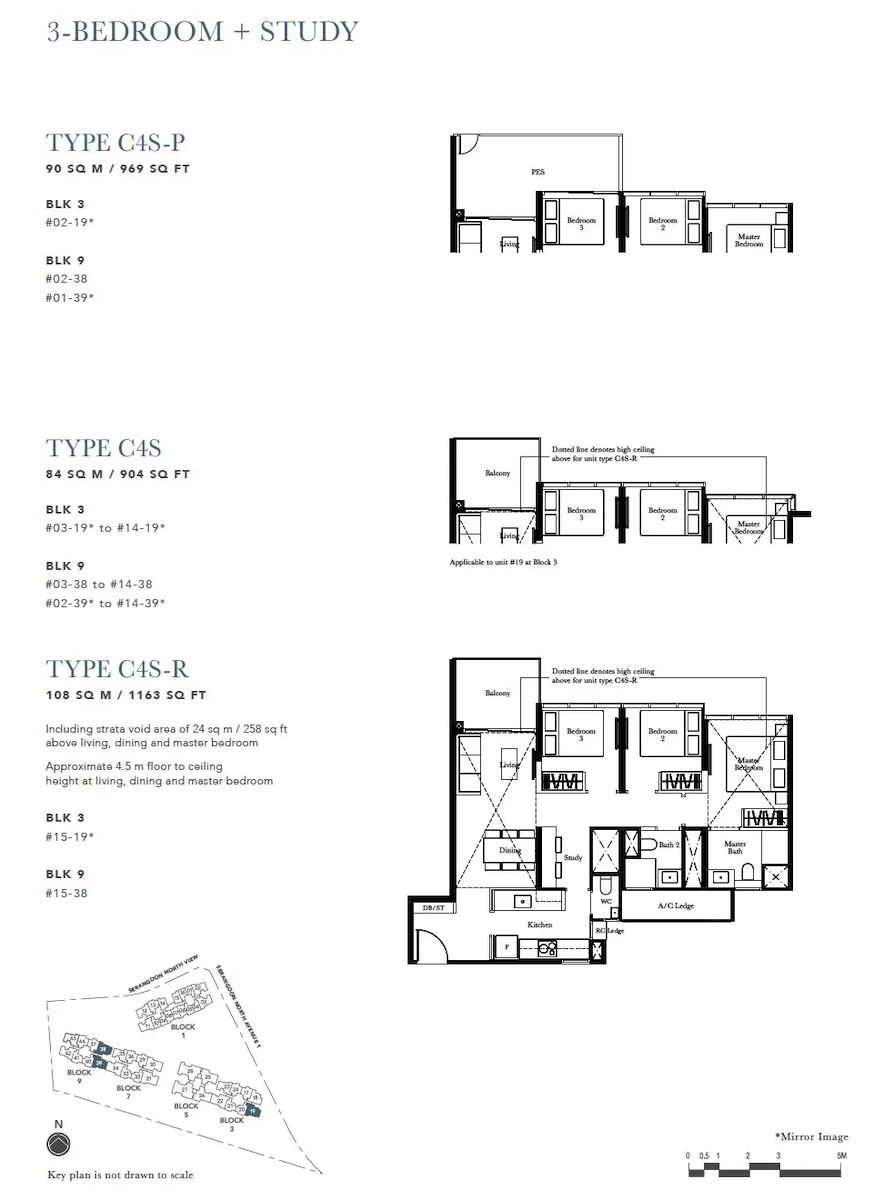

The 904 sq ft three bedroom + study unit will be the closest fit at the estimated budget. The study room which is accessible from the kitchen can be converted into a helper’s room and there is also an additional WC. The layout is generally efficient with minimal wastage of space. All bedrooms are also decently sized and are able to fit a double bed.

Since your kids are still really young, they probably will not need a double bed so that can be replaced with a single bed and study table instead.

There is no proper yard though, which may not be the most practical.

There has only been one of this unit type that transacted in the resale market in June this year at $1.7 million.

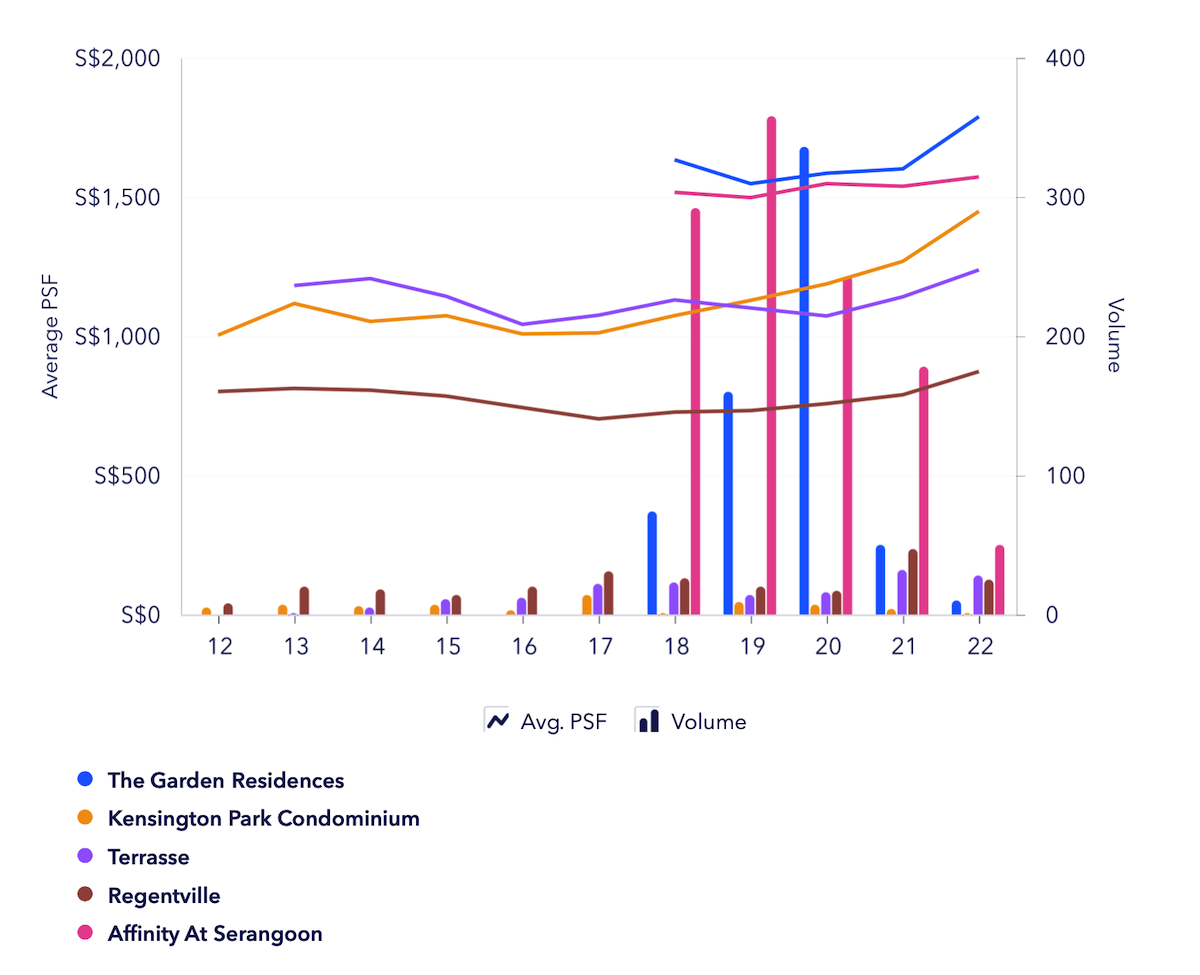

The Garden Residences and Affinity at Serangoon (which is still under construction), are the two newest projects in the area. Regentville and Terrasse are 26 and 12 years old respectively, while Kensington Park is a freehold development.

From the graph, you'll notice that the average psf for Kensington Park is lower than that of The Garden Residences even though it's a freehold project.

Don't be misled by that though, as the sizes of its units are much bigger so quantum wise buyers may be priced out and turn to the younger leasehold projects instead.

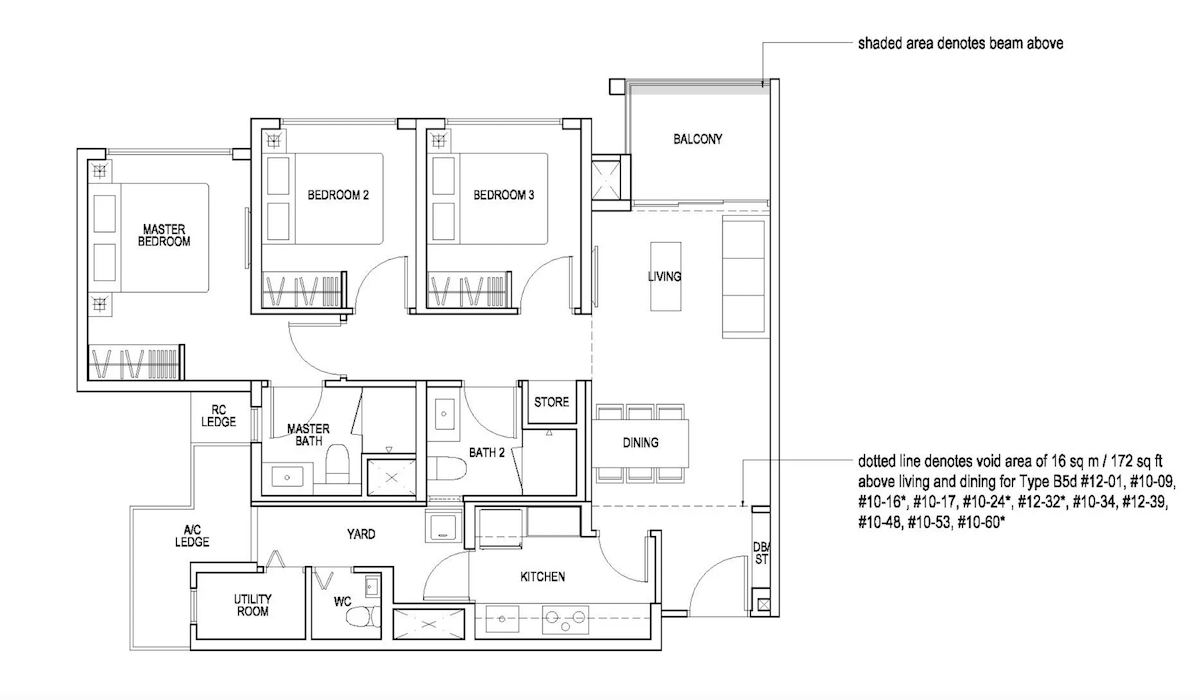

Gem Residences is another 99-year leasehold development that obtained its TOP in 2020. It is made up of 578 units spread across two towers consisting of one to five bedroom types. It’s within 1km of Pei Chun Public School and less than 10 minute's drive away from Bishan.

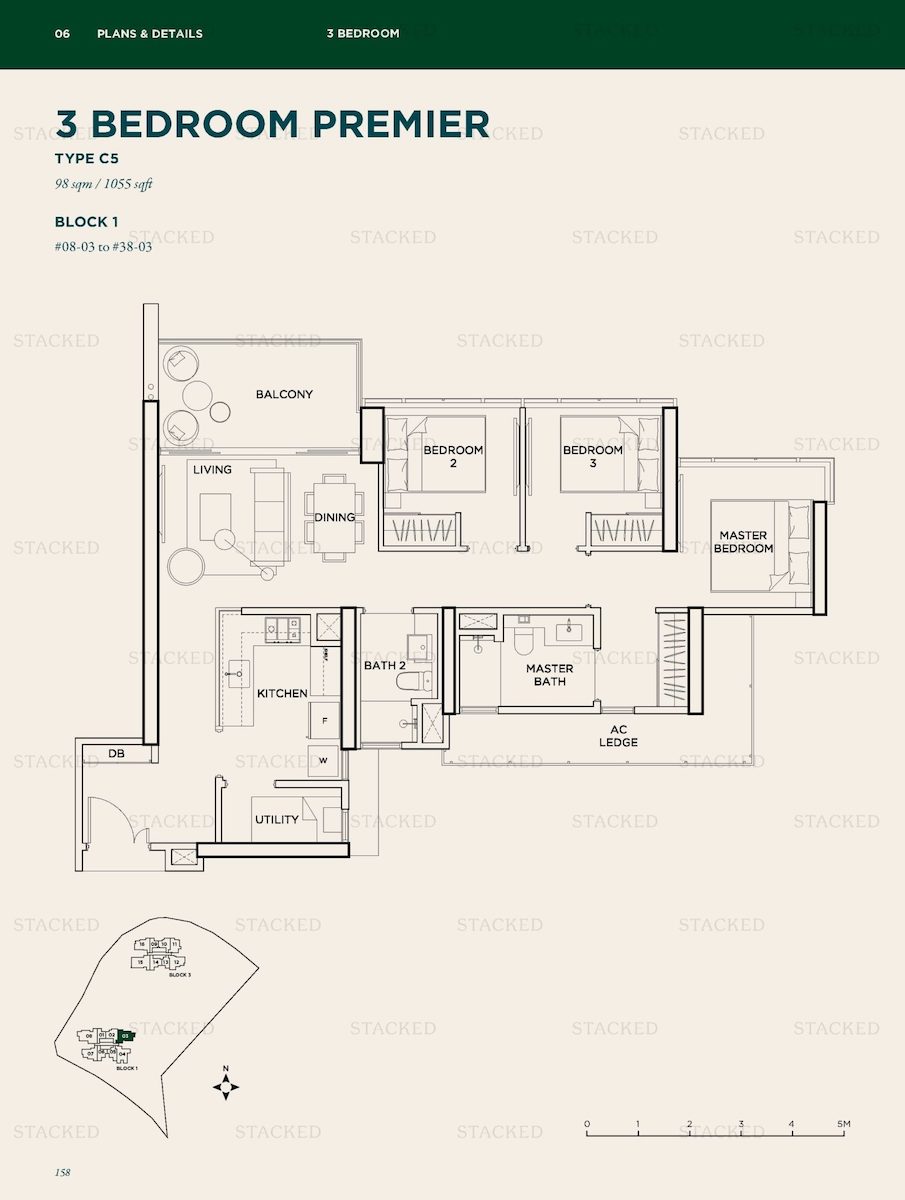

This 1,055 sq ft three bedroom premier unit meets your requirement of having three bedrooms and a utility. However it does not come with a WC in the kitchen, and neither is there a proper yard area.

The layout is functional but living and dining might feel abit cramped if you were to follow the above furniture placement. The balcony is spacious enough to be used as a dining area if you enjoy the alfresco vibes as it stretches the length of the living/dining space.

The master bedroom layout is quite different here as you do have a "walk-in wardrobe", although you don't exactly have more storage space here.

Do note that there is only one stack of this unit type so you might have to wait a while for such a unit to come on the market.

| Date | Size (sqft) | psf | Price | Type of sale | Level |

|---|---|---|---|---|---|

| July 2022 | 1,055 | 1,706 | $1,800,000 | Sub Sale | #34 |

| May 2022 | 1,055 | 1,830 | $1,930,000 | Sub Sale | #38 |

| Jan 2022 | 1,055 | 1,754 | $1,850,000 | Sub Sale | #27 |

| Jan 2022 | 1,055 | 1,782 | $1,880,000 | Sub Sale | #36 |

| June 2021 | 1,055 | 1,714 | $1,808,000 | Sub Sale | #17 |

| May 2021 | 1,055 | 1,678 | $1,770,000 | Sub Sale | #20 |

Source: Edgeprop

There have already been six sub-sale transactions for this unit type and they changed hands at an average price of $1,839,667.

Gem Residences is the newest kid on the block followed by Trevista which is 14 years old, Oleander Towers which is 27 years old, and Trellis Towers which is freehold.

The prices for Gem Residences have been growing steadily since its launch and given it's the youngest development in an area with a limited number of projects, there should be more demand here as well.

Riverfront Residences is also a 99-year leasehold development that is expected to TOP in 2024. It has a total of 1,472 units, out of which 1,451 are apartment units and 21 are strata-landed houses. It is within 1km of Holy Innocents' Primary and under 20-minute drive to Bishan.

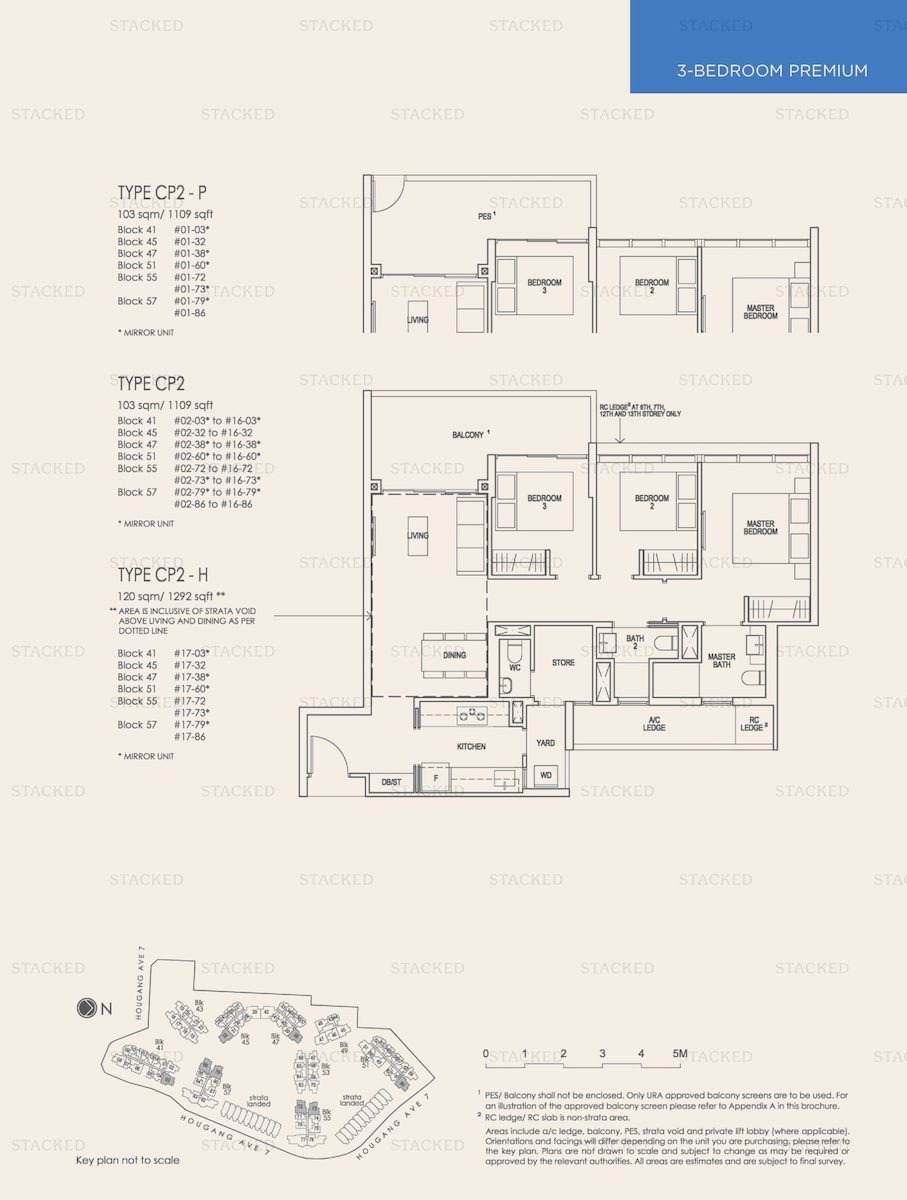

There are two sizes for the three-bedroom premier layout in this development, one is 1,066 sq ft and the other is 1,109 sq ft. Both layouts are the same except the 1,109 sq ft unit has a small DB and storage space between the entrance and the kitchen.

The unit is a good size and comes with three bedrooms, a ventilated store which can also be used as a helper's room, a WC and also a yard. Both bathrooms are also ventilated, so that's another good point, although the balcony is a bit of an awkward layout.

| Date | Size (sqft) | psf | Price | Type of sale | Level |

|---|---|---|---|---|---|

| May 2022 | 1,109 | 1,459 | $1,618,000 | Sub Sale | #08 |

| May 2022 | 1,109 | 1,551 | $1,720,000 | Sub Sale | #09 |

| Dec 2021 | 1,109 | 1,389 | $1,540,000 | Sub Sale | #07 |

There were three sub-sale transactions for this unit type and they went at an average price of $1,626,000.

Riverfront Residences will be the youngest project in the area once it’s completed. Evergreen Park, The Florida, Rio Vista, and Kingsford Waterbay are also 99-year leasehold projects and they are 27, 25, 21, and eight years old respectively.

We can see from the graph that prices of the older developments have started to get stagnant up until 2020 when the pandemic hit and overall property prices went up. Even though Riverfront Residences is still under construction, there have already been 97 sub-sale transactions so demand is definitely not lacking.

Now let’s compare with your existing unit, and see how it matches up.

This 990 sq ft three bedroom premier layout is definitely efficient. Bedrooms are decently sized and it also comes with a utility, yard, and WC.

Of the three developments, Riverfront Residences has the most comparable floor plan with a ventilated store that can be used as a helper’s room, yard, and WC. The Garden Residences lacks a yard which can be a useful space for doing your laundry.

Without a yard area, it’s likely you’ll have to use a dryer or air your laundry on the balcony which some may not quite like. Gem Residences lacks the yard and additional WC, which may be tough to forgo at this point if you are used to it.

Given the options available at the price point, it’s hard to really say that any of them are attractive enough that it would make it an easy and straightforward decision to sell and move home. Of course, there could be other resale options that may come up that may be more suitable, but it will be impossible for us to go through that in one article.

We believe that for family living, the layout of a home is very important. The basics have to be there, a yard, utility room for helper, and adequate storage options – all of which your current home now fulfils. To find the same liveability, only Riverfront Residences will be comparable.

[[nid:596825]]

As such, a move there will only make sense if you do value the closer drive to your parent’s home, and the proximity of good primary schools.

The problem is, that comes at the expense of a higher monthly repayment, and given the higher interest rate environment and uncertain economic outlook, perhaps this might not be the best to explore right now.

Plus, there is likely still potential for growth for The Brownstone (when you look back at the past history of EC sales) so there isn’t an immediate need to sell but it is definitely good to start planning early.

If anything, you do still have some time on your side given the ages of your child (and future one).

As you do not have any specific location in mind for your next property, it can get rather confusing and exhausting during your search as there will be a lot of options to look through. We suggest using this period to maybe narrow down on a few locations/developments so when the time comes that you’re ready to make the move, it will be easier.

The three developments we recommended are purely based on your requirements so as mentioned it will be best to speak with an agent and they can advise you whether or not these are suitable.

This article was first published in Stackedhomes.