We own a freehold 1-bedroom investment unit in District 10: How long would it take to profit $700k?

Thanks for sharing insightful property content to Singapore homeowners. I chance upon your website when searching for the latest property cooling measures. Reading your articles, I understand you offer non-biased opinion and honest recommendation without selling any services, unlike Property Agent. Is this too good to be true?

Well, let’s give it a try. Would be grateful to hear your opinion/suggestion on options we can take in this property investment journey towards our retirement plan.

We are a family of 3 living in Hillington Green (999) for the last 20 years. The price for this property was stagnant for long till the last few years that it finally increased. It is a 3+1 bedroom unit of 1528 sq ft.

This unit is under my husband’s name. We decoupled about 3+ years back to purchase an investment property under my name. The investment property is a 1-bedroom unit of 452 sq ft at 3 Cuscaden (FH) which was TOP in Nov 2022. It has been tenanted till March 2025.

We are not sure if we should keep 3 Cuscaden and continue with rental income in the long run, what is the upside to this or outlook for this location? Do you think it will fetch good capital appreciation if we keep it in the long run, but how long would it take to materialize a good return of at least $700k>? As you would know, we’ve incurred cost to decouple prior to purchasing this property.

Next, we plan to downsize in future when son gets married (hopefully in 3-4 years). According to URA master plan, there are few plots of GLS in front of Hillington but we don’t know when the new development will take place. Is this a good time to sell Hillington and get another property with better capital gain or wait for more new launch to take place in our area that should raise our property price? By the way, we just spent $250k renovated this house.

Well, to be clear. We do “sell” through our property consultations with exclusive agents that we work with, and we try as much as possible to be objective. That said, this advice column is where we try to work through the many emails and questions that we get.

And frankly, it does usually take a long number of hours just to work through these questions. And as much as we like to help, sometimes it is impossible to derive the right decision through the information sent.

Nevertheless, we try our best!

A notable advantage of both your properties is their freehold tenure, which eliminates concerns about lease decay in the event of short-term underperformance (as long as you have holding power).

In the piece, we will run through:

– Performance of properties in D10 – including 1-bedders in particular

– How long will it take to make $700k?

– Future prospect for 3 Cuscaden

– Should you sell Hillington Green in 3-4 years or wait?

Let’s start by looking at how freehold and 999-year leasehold properties have been performing in District 10.

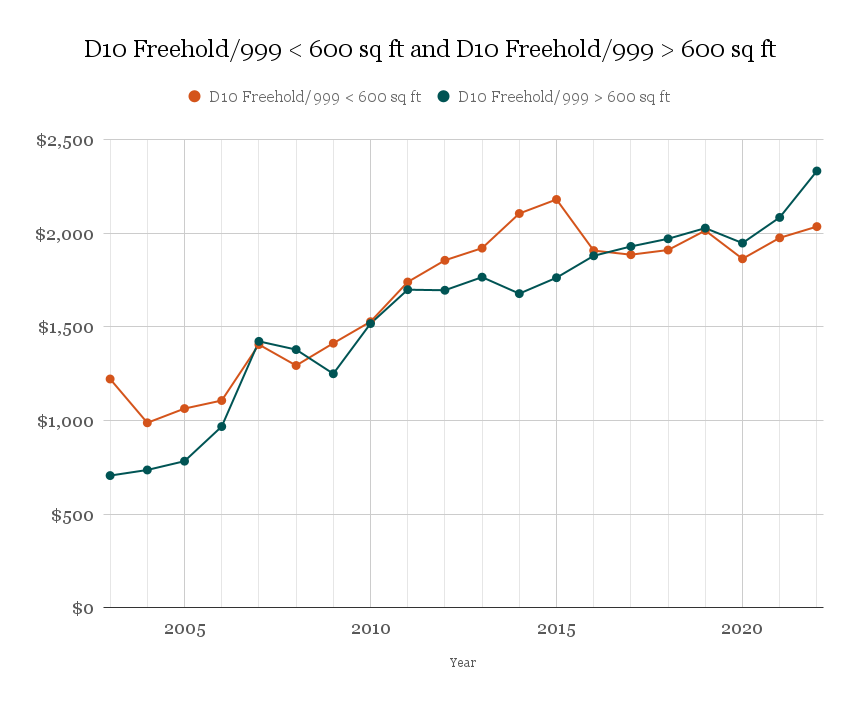

For this analysis, we’ll be looking at the performance of small units (< 600 sq ft) versus larger ones (> 600 sq ft) in D10. We’ll also only consider freehold/999-year leasehold properties to remove the effects of lease decay, something that 3 Cuscaden would not suffer from given its freehold status.

Here’s what the performance looks like:

| Year | D10 Freehold/999 < 600 sq ft | D10 Freehold/999 > 600 sq ft |

| 2003 | $1,222 | $706 |

| 2004 | $988 | $736 |

| 2005 | $1,064 | $783 |

| 2006 | $1,107 | $968 |

| 2007 | $1,406 | $1,423 |

| 2008 | $1,294 | $1,379 |

| 2009 | $1,413 | $1,250 |

| 2010 | $1,528 | $1,518 |

| 2011 | $1,740 | $1,699 |

| 2012 | $1,856 | $1,696 |

| 2013 | $1,921 | $1,766 |

| 2014 | $2,106 | $1,678 |

| 2015 | $2,181 | $1,763 |

| 2016 | $1,908 | $1,880 |

| 2017 | $1,886 | $1,930 |

| 2018 | $1,911 | $1,971 |

| 2019 | $2,015 | $2,028 |

| 2020 | $1,864 | $1,948 |

| 2021 | $1,976 | $2,085 |

| 2022 | $2,036 | $2,333 |

| Annualised | 2.72per cent | 6.49per cent |

Comparison between D10 freehold/999-year leasehold small and bigger units performance

From the table above, we can see that over the last 20 years, the annualised growth rate for freehold/999-year leasehold non-landed properties in D10 is higher than the overall growth rate of similar property types in Singapore.

But what’s interesting here isn’t so much the absolute price but its performance relative to each other:

Notice how 1 bedroom $PSF levels have not breached their resale highs since 2015? This is in contrast to bigger units (above 600 sq ft), which have been achieving record highs between 2016 – 2019 and again from 2021 – 2022.

There are a number of reasons for this. First, these units tend to be investor-owned due to their lower quantum. Investors tend to be less sticky on price as they count rental returns as part of their overall investment. Moreover, they are less likely to depend on the cash generated from liquidating the unit to upgrade/move to another home.

On the other hand, owner-occupiers do not generate rental returns and most people don’t take into account the opportunity cost of staying there as rental they would’ve paid elsewhere. As they don’t own any other properties, the returns generated from the sale are needed to fund their next home. Hence, many owner-occupiers find themselves “stuck” if they can’t sell at a price that allows them to meet their future objectives.

Some would also point out that the Covid-19 pandemic has a part to play in bigger units performing better. While this is true, you can already see bigger units outperforming smaller ones prior to 2020 when they breached their highs earlier than smaller units.

After all, District 10 attracts quite a different crowd – and in your case, 3 Cuscaden, being a luxury property, could also be affected by its location and type of development.

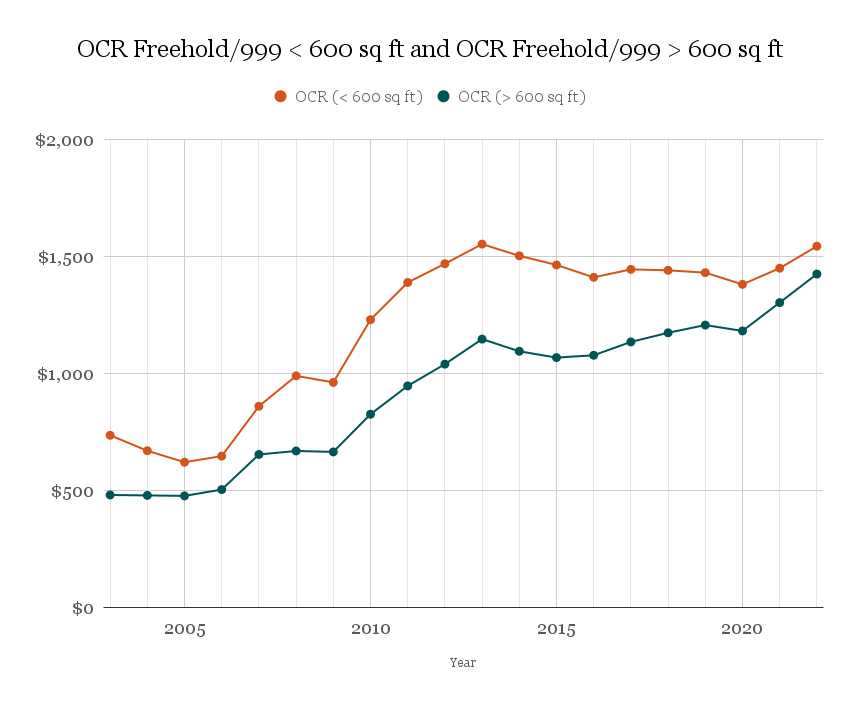

To uncover this, we’ll look at the $PSF performance over the same time period and tenure, except this time, we consider all resale transactions in the Outside of Central Region (OCR).

| Year | OCR (< 600 sq ft) | OCR (> 600 sq ft) |

| 2003 | $737 | $482 |

| 2004 | $671 | $480 |

| 2005 | $622 | $478 |

| 2006 | $648 | $505 |

| 2007 | $861 | $655 |

| 2008 | $991 | $670 |

| 2009 | $963 | $666 |

| 2010 | $1,231 | $827 |

| 2011 | $1,390 | $948 |

| 2012 | $1,470 | $1,041 |

| 2013 | $1,554 | $1,148 |

| 2014 | $1,504 | $1,096 |

| 2015 | $1,465 | $1,069 |

| 2016 | $1,412 | $1,079 |

| 2017 | $1,446 | $1,136 |

| 2018 | $1,442 | $1,175 |

| 2019 | $1,432 | $1,208 |

| 2020 | $1,382 | $1,183 |

| 2021 | $1,451 | $1,304 |

| 2022 | $1,545 | $1,426 |

| Annualised | 3.97per cent | 5.87per cent |

Comparison between OCR freehold/999-year leasehold small and bigger units performance

From the table above, you’ll see that 1-bedroom units tend to underperform when compared to units of other sizes on average. Its $PSF in 2022 is also close to the highs formed in 2013, but still under it.

This is consistent with our observations from our D10 analysis.

However, what’s notable here is that the relative performance between sizes is not as stark for OCR developments as it is for CCR developments.

Notice how the gap between annualised returns is 1.90 per cent for OCR, compared to the 3.77 per cent gap for District 10? It’s almost double!

One reason that can explain this is that the CCR (and District 10 for that matter) tends to have more foreign interest.

In the luxury home category, a small unit doesn’t exactly fit the bill even if it’s in a development built for luxury. While there is no traditional definition of what a truly luxurious property is (that term is overused by marketing teams), typically for higher-end buyers one of the more important points is the amount of space afforded for the unit.

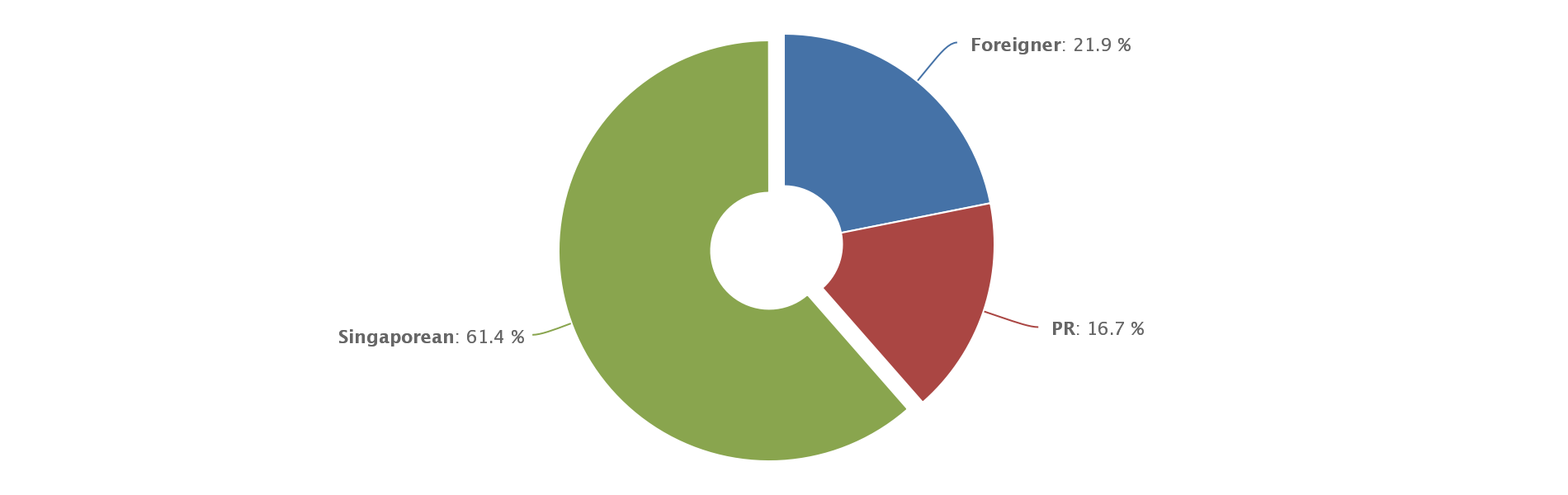

Here’s a look at the buyer profile for 3 Cuscaden:

Foreigners make up around 22 per cent of buyers here. While it’s not the majority, it’s expectedly higher than normal. Bear in mind that ABSD applies the strongest to companies and foreigners, and with the latest cooling measures in April, it’s likely that demand for luxury units in the CCR would be negatively affected.

In other words, the combination of having a small unit in a luxury development situated in an area where foreign interest in luxury homes tends to be higher may not bode so well over the next few years.

So far, we’ve taken a look at performances across the district, but let’s take a look at a condo close by with smaller units.

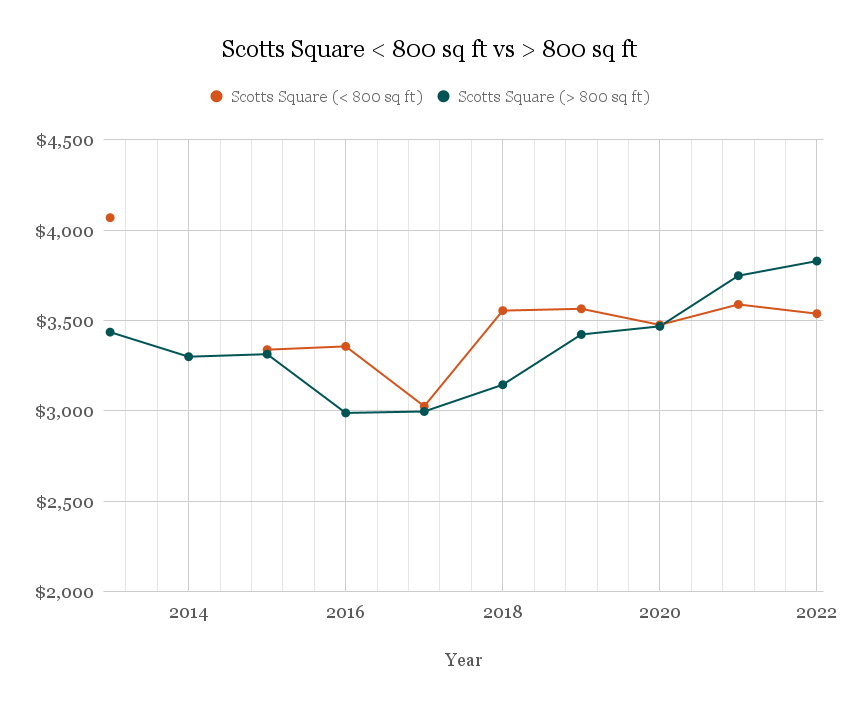

First off, there aren’t many condos in the area with small units. Scotts Square (freehold) has units that are larger than what 3 Cuscaden offers, but we wouldn’t venture too far out (e.g. Somerset area) to find one given it’s in quite a different locality.

The smallest units at Scotts Square start from 603 sq ft, so to isolate “small” from “bigger” units, we’ll use units below 800 sq ft.

Here’s how Scotts Square has performed in terms of resale prices:

| Year | Scotts Square (< 800 sq ft) | Scotts Square (> 800 sq ft) |

| 2013 | $4,069 | $3,436 |

| 2014 | – | $3,300 |

| 2015 | $3,339 | $3,314 |

| 2016 | $3,357 | $2,989 |

| 2017 | $3,026 | $2,997 |

| 2018 | $3,555 | $3,145 |

| 2019 | $3,565 | $3,423 |

| 2020 | $3,476 | $3,468 |

| 2021 | $3,589 | $3,748 |

| 2022 | $3,538 | $3,829 |

| Annualised | -1.54per cent | 1.21per cent |

Looking at the chart, you’ll find the performance to be similar to the overall district where smaller units tend to underperform compared to bigger units. In Scotts Square’s case, buyers from 2013 in general made a loss compared to those who bought bigger units.

The difference in annualised returns is 2.75 per cent – not nearly as wide as in D10, but still pretty significant.

The data has so far shown that the market isn’t too kind on small units – and even more so for those in the CCR. As there are no resale/sub sale transactions for 3 Cuscaden, it’s really a stab in the dark here to know whether the market would accept higher pricing than if you had bought today.

However, we can see that the transactions of 1-bedroom units in 3 Cuscaden transacted at an average of $3,600 from launch to date:

| Projects | Average $PSF (< 500 sq ft) | Vol. |

| 120 GRANGE | $3,301 | 8 |

| 3 CUSCADEN | $3,600 | 45 |

| 38 JERVOIS | $2,415 | 1 |

| JERVOIS MANSION | $2,721 | 15 |

| LEEDON GREEN | $2,792 | 44 |

| M5 | $2,256 | 4 |

| THE ENCLAVE . HOLLAND | $2,642 | 6 |

| THE HYDE | $2,908 | 18 |

| VAN HOLLAND | $2,998 | 8 |

| WILSHIRE RESIDENCES | $2,567 | 10 |

This figure represents a substantial 28.5per cent increase compared to the average PSF of new freehold/999-year leasehold units below 500 sq ft in D10, which was recorded at $2,801 between 2018 – 2022 (when 3 Cuscaden was sold). Of course, not every location in D10 is the same and 3 Cuscaden is marketed as a luxury property. As a result, it does have the inherent advantage of being able to command higher prices.

It is also the newest option if you want to stay in the Orchard area and have a more modest budget, so it could cater well to a niche market.

Regardless, it’s still more costly compared to other D10 condos, so we have to take this into consideration especially since buyers in the resale market would be making comparisons like we do.

Now that we’ve got the performance out of the way, let’s answer your next question:

Your returns are a function of capital appreciation and rental gains less the cost to hold onto the property.

Rental gains and costs can be forecasted with a decent amount of certainty, however, coming up with the capital appreciation is like throwing a dart blindfolded.

Considering freehold/999-year leasehold units have averaged 2.72per cent over the past 20 years, we’ll use this as the basis of capital appreciation. It could be more or less, but given the aforementioned reasons for why small units aren’t as favoured, it could even be worse.

(Bear in mind that even at 2.72per cent, properties of other sizes could outperform this in the long run, so even with gains over the years, you could be losing out on better performance elsewhere.)

Next, let’s consider the rental for 1-bedders at 3 Cuscaden:

| Date | Size | Price |

| 1 Mar 2023 | 400 to 500 | $5,500 |

| 1 Feb 2023 | 400 to 500 | $5,500 |

| 1 Feb 2023 | 400 to 500 | $5,500 |

| 1 Jan 2023 | 400 to 500 | $6,000 |

| 1 Jan 2023 | 400 to 500 | $5,800 |

| 1 Jan 2023 | 400 to 500 | $4,700 |

As we do not know how much you purchased the unit for and how much you’re renting it at, we will use the average PSF of $3,600 for the purchase price which amounts to $1,627,200 for a 452 sq ft unit and the average rent of $5,500/month.

This comes to a yield of 4per cent which is really generous for a freehold luxury property in D10 (of course, rental rates are at a high right now).

We are also assuming you took a 75 per cent loan at 4per cent interest with a 20-year tenure.

Total costs include interest expense, BSD, property tax, maintenance fees which we have set at $500/month and agency fees payable every 2 years.

| Period | Total Cost | Total Gains | Profit |

| Starting Period | $56,900 | $0 | -$56,900 |

| Year 1 | $ 123,936 | $ 110,260 | $ (13,676) |

| Year 2 | $ 195,255 | $ 221,724 | $ 26,469 |

| Year 3 | $ 258,909 | $ 334,424 | $ 75,515 |

| Year 4 | $ 326,709 | $ 448,394 | $ 121,686 |

| Year 5 | $ 386,701 | $ 563,670 | $ 176,969 |

| Year 6 | $ 450,689 | $ 680,285 | $ 229,596 |

| Year 7 | $ 506,714 | $ 798,278 | $ 291,564 |

| Year 8 | $ 566,574 | $ 917,684 | $ 351,111 |

| Year 9 | $ 618,302 | $ 1,038,544 | $ 420,242 |

| Year 10 | $ 673,689 | $ 1,160,895 | $ 487,206 |

| Year 11 | $ 720,764 | $ 1,284,779 | $ 564,016 |

| Year 12 | $ 771,308 | $ 1,410,238 | $ 638,930 |

| Year 13 | $ 813,341 | $ 1,537,314 | $ 723,973 |

In this case, you’ll need around 13 years to achieve a profit above $700K.

But what if we assume just a 1per cent growth? Let’s see what this more conservative approach gets us:

| Period | Total Cost | Total Gains | Profit |

| Starting Period | $56,900 | $0 | -$56,900 |

| Year 1 | $123,936 | $82,272 | -$41,664 |

| Year 2 | $195,255 | $164,707 | -$30,548 |

| Year 3 | $258,909 | $247,306 | -$11,603 |

| Year 4 | $326,709 | $330,071 | $3,362 |

| Year 5 | $386,701 | $413,004 | $26,303 |

| Year 6 | $450,689 | $496,106 | $45,417 |

| Year 7 | $506,714 | $579,379 | $72,665 |

| Year 8 | $566,574 | $662,824 | $96,251 |

| Year 9 | $618,302 | $746,445 | $128,143 |

| Year 10 | $673,689 | $830,241 | $156,552 |

| Year 11 | $720,764 | $914,216 | $193,452 |

| Year 12 | $771,308 | $998,370 | $227,062 |

| Year 13 | $813,341 | $1,082,705 | $269,365 |

| Year 14 | $858,638 | $1,167,224 | $308,586 |

| Year 15 | $895,212 | $1,251,929 | $356,717 |

| Year 16 | $934,827 | $1,336,820 | $401,993 |

| Year 17 | $965,486 | $1,421,900 | $456,415 |

| Year 18 | $998,946 | $1,507,171 | $508,225 |

| Year 19 | $1,023,199 | $1,592,635 | $569,436 |

| Year 20 | $1,049,992 | $1,678,293 | $628,301 |

| Year 21 | $1,068,952 | $1,764,148 | $695,196 |

| Year 22 | $1,093,852 | $1,850,202 | $756,350 |

Generating a profit of $700k takes about 21 years! Over the long run, if small 1-bedroom units in District 10 continue to underperform other units, this could very well be the reality you’d have to risk facing.

With 3 Cuscaden being a freehold development, the concern of lease decay is effectively eliminated, if you can afford a long term hold. However, District 10 is not short of freehold properties.

There are two types of gains here, absolute and relative.

Absolute gains are when we look at the absolute returns here such as in the above analysis. Relative gains use a capital appreciation rate indicative of whether it underperforms (negative), outperforms (positive) or moves in line with the overall property market (0per cent).

Looking at relative gains makes sense if your opportunity cost is buying another property instead of continuing your investment in 3 Cuscaden.

If the property market rises as a whole, a 1 per cent increase here means your investment is outperforming the market by 1 per cent. A 0per cent return rate indicates your property moves in line with the overall property market.

Let’s assume your 1 bedder at 3 Cuscaden performs in line with the property market – this makes it a 0 per cent capital appreciation rate (since you’re only achieving real estate inflation here). This is how long it takes to make $700K:

| Period | Total Cost | Total Gains | Profit |

| Starting Period | $56,900 | $0 | -$56,900 |

| Year 10 | $673,689 | $660,000 | -$13,689 |

| Year 20 | $1,049,992 | $1,320,000 | $270,008 |

| Year 30 | $1,269,292 | $1,980,000 | $710,708 |

As you can see, it takes around 30 years to turn your 1-bedroom investment into $700K after accounting for rental gains and all of its associated costs.

Running this simulation showcases how trying to earn purely from rental makes it very difficult to make money given the costs associated with property ownership. The best way to make money in property (since it’s leveraged) is through capital appreciation. After all, most of the cost from rental returns gets eaten up by interest costs, maintenance fees, property tax and so on.

This exercise also shows just how a small annualised return could drastically affect your returns over a period of time.

Your goal for a property investment should be in finding a property that could see good capital appreciation over time. Given the aforementioned reasons, we’d re-consider allocating your funds to another form of investment or a bigger unit that’s perhaps not so centrally located and has more growth potential.

Of course, that’s not to say that the area around 3 Cuscaden lacks growth potential. Let’s take a look at the future prospects of the location.

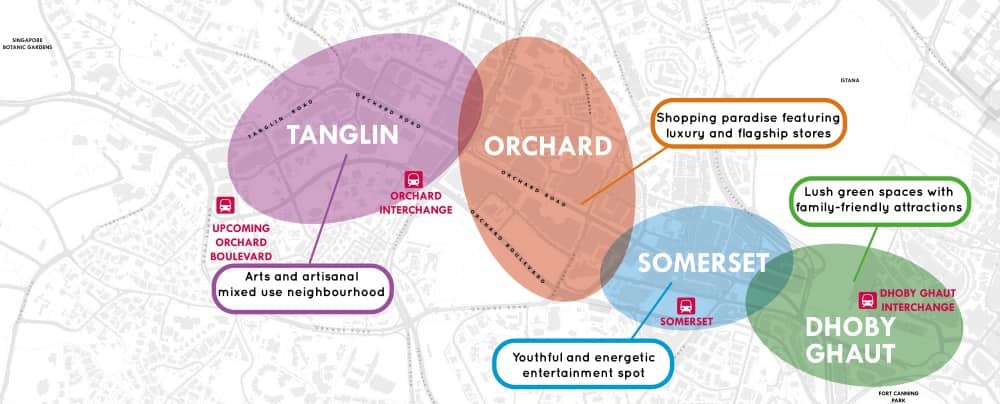

Properties located along the Orchard shopping belt have gained a reputation for their association with luxury and exclusivity. The combination of upscale shopping malls, renowned hotels, and diverse dining and entertainment options creates a unique and exclusive lifestyle that draws affluent buyers and tenants to the area.

Let’s take a look at the URA master plan.

Although the majority of the location has been developed, there are still several vacant plots. While one site is earmarked for residential properties, most are reserve sites which means their specific use has yet to be determined.

There are however major plans to revamp the various sub-precincts in the Orchard area and URA has stated that “The vacant State Land parcels at Orchard Boulevard present opportunities for exciting mixed-use developments above the upcoming Thomson-East Coast Line Orchard Interchange MRT, which can also be connected to Orchard Road via bustling side streets.”

The Orchard shopping district has an abundance of projects. Within such a fiercely competitive environment, the introduction of a new development may not wield as significant an influence, given the saturation of the market. With a large number of existing units and the potential addition of new ones, there is a risk of reaching a saturation point where demand fails to meet the abundant supply. As a result, this situation could adversely affect prices.

On the other hand, the introduction of additional amenities has the potential to further enhance the appeal of the location by increasing convenience and adding greater value for the residents. This improvement in amenities could contribute to making the area even more desirable, thereby attracting a larger pool of potential buyers and tenants.

The recent hike in Additional Buyer’s Stamp Duty (ABSD), particularly for foreign investors, presents another obstacle for properties situated in the Core Central Region (CCR), which is a favoured location for many overseas buyers. Despite the fact that foreign buyers may not make up a majority of the buyer pool, it is important to recognise that this policy change will inevitably result in a decrease in the number of potential buyers within this group.

Having discussed your investment property, let’s now look at your own stay property.

| Year | Hillington Green | D23 Freehold/999y non-landed (resale) | All Freehold/999y (non-landed) resale |

| 2003 | $510 | $491 | $564 |

| 2004 | $506 | $467 | $572 |

| 2005 | $441 | $442 | $601 |

| 2006 | $466 | $440 | $750 |

| 2007 | $658 | $576 | $920 |

| 2008 | $671 | $628 | $863 |

| 2009 | $654 | $606 | $861 |

| 2010 | $777 | $750 | $1,049 |

| 2011 | $917 | $867 | $1,196 |

| 2012 | $984 | $945 | $1,289 |

| 2013 | $1,086 | $1,026 | $1,427 |

| 2014 | $1,061 | $1,000 | $1,366 |

| 2015 | $992 | $974 | $1,365 |

| 2016 | $975 | $944 | $1,396 |

| 2017 | $1,016 | $967 | $1,466 |

| 2018 | $1,049 | $1,062 | $1,543 |

| 2019 | $1,123 | $1,112 | $1,575 |

| 2020 | $1,153 | $1,108 | $1,504 |

| 2021 | $1,202 | $1,231 | $1,592 |

| 2022 | $1,411 | $1,362 | $1,714 |

| Annualised | 5.50per cent | 5.52per cent | 6.02per cent |

We can see from the graph and table above that prices at Hillington Green are moving in line with other freehold/999-year leasehold developments in D23.

Comparing this with the growth rate of all freehold/999-year leasehold developments in Singapore which is at 6.02per cent, Hillington Green is not too far off – though over time, a small annualised difference like this could make quite a difference!

Here are some recent 1,528 sq ft unit transactions:

| Date | Size (sq ft) | PSF | Price | Level |

| 26 Apr 2023 | 1,528 | $1,588 | $2,428,000 | #03 |

| 29 Dec 2022 | 1,528 | $1,492 | $2,280,000 | #07 |

| 27 Sep 2022 | 1,528 | $1,505 | $2,300,000 | #09 |

We will use the average PSF to perform a straightforward calculation.

Suppose you bought the unit in 2002 at $557 PSF, resulting in a total cost of $851,096. Now, compare this with the most recent transaction in April this year, where a #03 unit was sold for $2.428M. This translates to a profit of $1.5M. Do note that we haven’t taken into account additional expenses such as interest, BSD, decoupling costs, etc.

Considering the substantial investment you’ve made in renovations, it would be a shame not to fully enjoy the recently improved living space for an extended period. If there isn’t an immediate need to move, holding onto the unit might not be the worst decision given its tenure.

Given the unit’s favourable location near amenities, renowned schools, and nature parks, properties in the Hillview area generally have a healthy demand, especially those with a freehold status.

The Hillview area also has several plots around that could see new launches propping up the price of Hillington Green further. This is because the cost of land is always going up, so developers would have to sell higher. As they do, buyers would be making comparisons to alternatives in the area, and if the new launch sells well, we can reasonably expect the prices of Hillington Green to reflect this accordingly.

However, if downsizing to a smaller unit is a priority for you, it’s worth considering whether the profits gained justify selling the newly renovated unit.

In short, we think it makes sense to hold onto Hillington Green, while looking out for an alternative investment away from 3 Cuscaden. Here’s why:

While the general growth rate of freehold/999-year leasehold 1-bedders shows a less than favourable trend, it’s important to note that this trend can vary among different projects, as observed in the various developments within D10.

Depending on your future plans, the extended holding period required to realise a profit of $700k may or may not align with your objectives. 3 Cuscaden is a freehold property, so holding onto it for the long term while staying in it to enjoy the property makes sense if you have legacy planning in mind.

But as an investment, it would make more sense to consider reallocating your resources to a project with better potential for capital appreciation soon. This is especially so since the loan you can take is reduced each year given the tenure decreases since banks aren’t willing to provide a loan past the age of 65.

[[nid:627775]]

We have highlighted the rejuvenation of the Orchard area as one reason for the price at 3 Cuscaden to outperform other developments. However, this has yet to materialise and it remains unknown how long that timeline would take.

At the end of the day, prices in the area are high due to its centrality. Further improvements to the area may only see a marginal increase in value for residential properties. If we compare rejuvenation plans here to other areas, the impact elsewhere on property value would likely be higher since it’s less developed.

It’s akin to building another MRT station in an area that already has an MRT – how much more of an impact can this make compared to building an MRT station near a condo that has none within walking distance?

You could consider purchasing a 2-bedroom unit instead of a 1-bedder in the OCR. A 2-bedroom unit has better resale value as you can derive better rentals by renting rooms instead of the whole unit, and you could also only rent out one room as a cushion in the event of a slow rental market.

Now, turning our attention to Hillington Green, it is evident that prices have experienced significant appreciation over the past 20 years, indicating a potentially substantial return on investment. However, considering the extensive renovations you have undertaken, which costs a considerable amount of a quarter million dollars, it is crucial for the profits generated to justify these expenses.

Examining the price trends at Hillington Green in relation to other freehold/999-year leasehold developments in D23, it is clear that they have moved in line with the overall market prices. Given the performance of freehold/999yr leasehold projects in the Hillview area, it is reasonable to expect that prices will continue to follow the market trend.

Therefore, if there is no urgent need to relocate and the profits obtained (taking into account the renovation costs) do not justify selling the property, holding onto it for an extended period is unlikely to have a negative impact on its profitability.

This article was first published in Stackedhomes.