Is the $16k condo income ceiling too low? A look at how new condo prices have risen and why it should be raised

The income ceiling for Executive Condos currently stands at $16,000. But there has been discussion lately over whether it's time to raise this income ceiling, along with that of BTO flats. It doesn't surprise us to hear it: amid rising interest rates, high inflation, and fully-private homes getting out of reach, there are real fears that a low-income ceiling would leave more Singaporeans truly "sandwiched".

Before we dive into the state of things now, let's take a look at how income ceilings have been raised over the years.

| Period | Max Household Income |

| Before 2011 | $10,000 |

| 2011 – 2015 | $12,000 |

| 2015 – 2019 | $14,000 |

| 2019 – Present | $16,000 |

The income ceiling prior to 2011 was at $10,000 for over 10 years. It wasn't necessary to raise it prior due to the Asian Financial Crisis, DotCom Bubble bursting and the SARS period. However, the run up of property prices from 2008 saw the need to increase the income ceiling with rising wages and property prices.

This table describes the minimum, average and maximum $PSF and price of new ECs since 1996:

Notice how in 2023 so far, the average prices of new ECs stood at $1,486,906. This is about $500,000 more than in 2018. The last time prices were $500,000 less was 13 years before that — 2005.

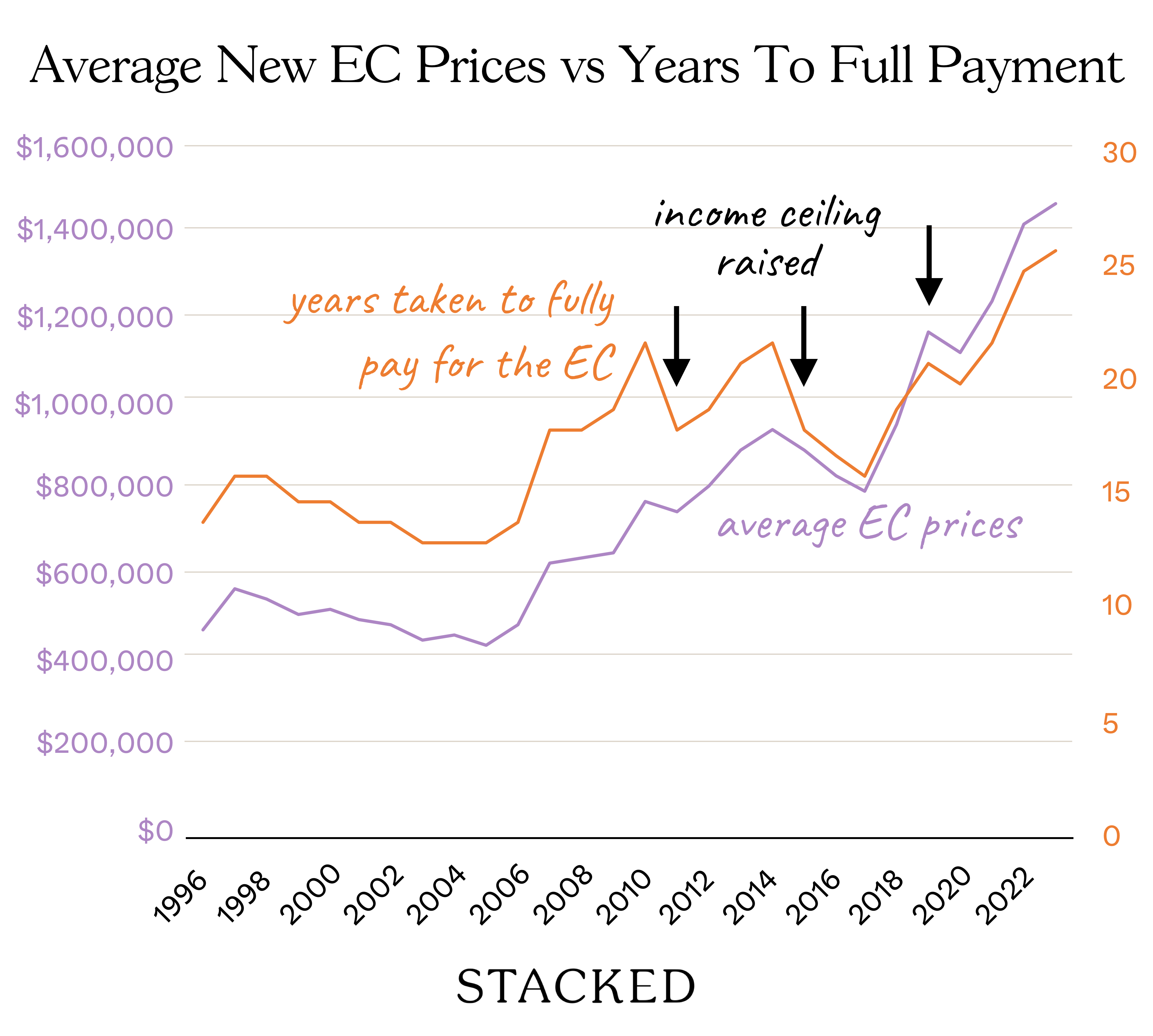

How does this relate to the income ceiling? Here's a look at the average prices of new ECs and the income ceiling:

If we assumed that couples earn an income equivalent to the income ceiling and paid 30 per cent of their income towards the house alone (doesn't include interest expense or the deposit), then here's how long it takes for them to pay it off:

Prior to 2008, it takes roughly 15 years to fully pay off one's EC. In 2009 and 2010, property prices moved quickly, raising the number of years it takes to fully pay off one's EC to 22 years.

Then, the income ceiling was raised from $10,000 to $12,000 which brought this number back down to 18 years.

As prices continued to move up in 2014, the number of years rose again to 22 years.

This was brought back down to 18 years once more with the increase in income ceiling from $12,000 to $14,000.

The number of years taken to pay off an EC completely remained between 16 to 19 years. In 2019, the ceiling was raised from $14,000 to $16,000.

Since then, the number of years taken to pay off an EC rose dramatically from 21 years to 26 years — the most unaffordable at this point in history.

To illustrate just how low this income ceiling is relative to prices, let's look at the latest Executive Condo launch, Altura.

At a starting psf of $1,375, this means that the most affordable unit would go at about $1.347 million.

If we consider the MSR of 30 per cent and the medium-term interest rate framework MAS set at four per cent in calculating mortgage payments, then the maximum amount an EC should be priced at is around $1,340,552 before the buyer has to put down more than the 25 per cent requirement. (Note, this assumes a 30-year loan).

As such, given that $1,340,552 is the minimum, the starting price of Altura EC at $1.347 million means that on top of the usual 25 per cent downpayment (a mix of cash + CPF), the minimum top-up a buyer has to make here is $6,948 — and it can only get higher.

Aside from this, there are ongoing factors that may still prompt a revision:

*75 per cent LTV from a bank loan, HDB loans are not available for ECs

We wouldn't be surprised if the interest rate floor for the TDSR goes higher, and soon. Private bank rates, which were once as low as two per cent in 2018, are reaching averages of close four per cent per annum.

But keep in mind the floor rate is supposed to be higher than the actual interest rate; this is to ensure borrowers can cope when interest rates rise. But in the US, we've seen 10 rate hikes since the end of Covid, as they try to lower inflation — this is having a knock-on effect on Singapore's mortgage rates, which brokers now expect to reach five per cent by the end of this year, or early in 2024.

(And the Fed has been especially hawkish, so there's a chance it won't even end there)

Pushing up the interest rate floor will cause projected monthly repayments to rise, and will in turn require higher incomes to qualify.

As a good example of this, we were recently speaking to a couple who earned a combined $19,000+ per month.

At such a salary level, you might assume they have no issues buying a private property. However, the couple has elderly parents on both sides of the family, who need ongoing treatment; this includes dialysis costs and a live-in nurse. They don't qualify for many subsidies due to their income level.

Along with raising two children, the couple's expenses already consume close to half their monthly income, without factoring in housing. Taking on a fully private, family-sized condo would definitely strain them past prudent limits.

They eventually settled for a resale executive flat. But it would have been ideal if they could have bought a new EC, with a fresh lease given their (still relatively young) age.

We might also consider that the people who can't get ECs, and also can't get private condos, might add to the demand and price increases for resale flats.

Developers are facing slimmer margins, higher ABSD rates, higher costs for labour and materials, and higher financing costs due to rising interest rates. Despite this, they're required to price ECs with regard to the income ceiling, MSR, and TDSR. Something has to give.

You might have noticed a trend of "luxury ECs" starting around 2020, with the likes of Ola appearing on the market. These ECs are aggressively marketed as being more "prime" than typical housing of the sort, and we don't think it's a fully deliberate choice.

Given their higher costs, developers need to find every possible way to justify the price increments; and this "luxury" labelling is a symptom of that.

But unless some concessions are made (e.g., developers of ECs get some kind of reduction in Land Betterment Charges or ABSD), developers are going to keep trying to push the price; and a higher income ceiling will eventually be needed to accommodate that.

For those who haven't noticed, ECs tend to be in less mature areas, and areas further from the MRT station. It's not always true, but it's mostly true. We're certain that this move is entirely deliberate.

One of the reasons is that ECs are a good tool for getting Singaporeans — particularly the ones rich enough to afford more than a flat — into some of the more "ulu" neighbourhoods. Parc Canberra is one example, and we suspect Tengah Garden Walk will do the same.

This is also how we incentivise private developers to contribute to urban development in more fringe neighbourhoods.

By raising the income ceiling, ECs could potentially convince more home buyers to move into currently fringe areas. This steps up the pace of development in those neighbourhoods, if for no reason besides justifying more coffee shops, retail stores, childcare centres, etc.

ALSO READ: 2-room Tiong Bahru HDB flat sold for record $585k, with 48.5 year lease left

This article was first published in Stackedhomes.