20 biggest condo transaction losses that were bought and sold during Covid-19

Success stories abound in the Singapore property market, because those stories sell condos (a little sceptical, but it’s an unavoidable truth).

A lot of these highlighted condos also paint a glamourous picture of their districts and areas; and it may create the sense that you can’t go wrong in those areas.

So as counterintuitive as it sounds; the districts that have the ritziest condos can sometimes be the ones that also see the worst losses (also not the first time that we’ve brought it up):

Veteran property investors won’t be surprised; but for those new to the market, consider that CCR and RCR districts may not, in fact, be the recession-proof titans that some agents claim they are.

It seems that the priciest districts can also bring about the priciest losses:

| District | Segment | Gain (Vol.) | Gain (Avg per cent) | Loss (Vol.) | Loss (Avg per cent) | Total Vol. | Avg per cent | Loss Proportion |

| District 4 | RCR | 4 | 22.2 per cent | 3 | -6.5 per cent | 7 | 9.9 per cent | 42.86 per cent |

| District 1 | CCR | 9 | 23.6 per cent | 4 | -7.2 per cent | 13 | 14.1 per cent | 30.77 per cent |

| District 2 | CCR | 4 | 10.0 per cent | 1 | -5.0 per cent | 5 | 7.0 per cent | 20.00 per cent |

| District 9 | CCR | 21 | 16.0 per cent | 3 | -9.7 per cent | 24 | 12.8 per cent | 12.50 per cent |

| District 11 | CCR | 10 | 18.6 per cent | 1 | -1.8 per cent | 11 | 16.7 per cent | 9.09 per cent |

| District 16 | OCR | 17 | 37.7 per cent | 1 | -1.1 per cent | 18 | 35.5 per cent | 5.56 per cent |

| District 10 | CCR | 37 | 20.7 per cent | 2 | -0.5 per cent | 39 | 19.6 per cent | 5.13 per cent |

| District 12 | RCR | 19 | 25.0 per cent | 1 | -1.7 per cent | 20 | 23.7 per cent | 5.00 per cent |

| District 3 | RCR | 40 | 19.5 per cent | 2 | -5.1 per cent | 42 | 18.3 per cent | 4.76 per cent |

| District 15 | RCR | 53 | 27.8 per cent | 1 | -5.7 per cent | 54 | 27.2 per cent | 1.85 per cent |

| District 19 | OCR | 120 | 21.1 per cent | 1 | -6.4 per cent | 121 | 20.8 per cent | 0.83 per cent |

| Project | Price Bought | Size | $PSF | Date Bought | Planning Area | $ Loss | Per cent Loss |

| THE FORESTA @ MOUNT FABER | $1,160,000 | 538 | 2155 | 2/12/21 | Bukit Merah | -$170,000 | -14.66 per cent |

| NEWTON EDGE | $1,265,000 | 743 | 1703 | 20/1/21 | Novena | -$165,000 | -13.04 per cent |

| 8 SAINT THOMAS | $2,900,000 | 1044 | 2777 | 23/7/20 | River Valley | -$373,000 | -12.86 per cent |

| MARINA BAY RESIDENCES | $1,500,000 | 710 | 2111 | 8/7/21 | Downtown Core | -$150,000 | -10.00 per cent |

| MARINA ONE RESIDENCES | $6,362,000 | 2045 | 3111 | 20/9/21 | Downtown Core | -$562,000 | -8.83 per cent |

| MARINA ONE RESIDENCES | $4,425,062 | 1582 | 2797 | 18/1/21 | Downtown Core | -$388,000 | -8.77 per cent |

| RIVIERE | $4,197,600 | 1711 | 2453 | 5/11/20 | Singapore River | -$297,600 | -7.09 per cent |

| BARTLEY VUE | $1,421,000 | 657 | 2164 | 27/9/22 | Toa Payoh | -$91,000 | -6.40 per cent |

| SEASIDE RESIDENCES | $2,108,800 | 1270 | 1660 | 29/8/20 | Bedok | -$120,000 | -5.69 per cent |

| ALTEZ | $1,600,000 | 861 | 1858 | 22/7/22 | Downtown Core | -$80,000 | -5.00 per cent |

| SKYLINE 360 @ SAINT THOMAS WALK | $4,750,000 | 2131 | 2229 | 25/2/20 | River Valley | -$150,000 | -3.16 per cent |

| THE CREST | $1,562,120 | 797 | 1961 | 6/8/20 | Bukit Merah | -$48,620 | -3.11 per cent |

| REFLECTIONS AT KEPPEL BAY | $2,788,800 | 1862 | 1498 | 28/1/20 | Bukit Merah | -$80,800 | -2.90 per cent |

| THE INTERLACE | $2,170,000 | 1615 | 1344 | 13/2/20 | Bukit Merah | -$40,000 | -1.84 per cent |

| PARK INFINIA AT WEE NAM | $3,410,000 | 1464 | 2329 | 12/6/23 | Novena | -$60,000 | -1.76 per cent |

| RITZ MANSIONS | $1,200,000 | 861 | 1394 | 8/2/21 | Novena | -$20,000 | -1.67 per cent |

| MARINA ONE RESIDENCES | $1,642,113 | 743 | 2211 | 22/4/20 | Downtown Core | -$22,113 | -1.35 per cent |

| URBAN VISTA | $870,000 | 624 | 1394 | 21/9/20 | Bedok | -$10,000 | -1.15 per cent |

| 25C HOOT KIAM ROAD | $1,338,000 | 1012 | 1322 | 19/4/21 | Tanglin | -$8,000 | -0.60 per cent |

| D’LEEDON | $3,380,000 | 1679 | 2013 | 9/10/23 | Bukit Timah | -$15,000 | -0.44 per cent |

Caveat: These transactions were all only bought and sold within the last three years, to give you a sense of how each district has performed since Covid-19.

Because generally most properties that were bought during the early days of the pandemic would have seen some form of appreciation, it was interesting to point out those that still lost money.

Of course, we have to note that this also isn’t a significant number of transactions to begin with, as it is just over a three-year period.

For a more detailed explanation, check out this article on why freehold luxury condos (typically the ones in the prime areas above) are prone to bigger losses.

In general, it boils down to the buyer demographic (some of these are owned by super-affluent people who don’t care whether they make money), and the fact that you already buy at peak prices in many of these districts.

This is compared to the further out regions where the majority of the buyers are buying for their own stay and the demand is supported by HDB upgraders.

As of 2024 though, there may be another factor coming into play. The ABSD on foreigners has now risen to 60 per cent; and this demographic is most present in the CCR (and to some extent, the RCR).

With foreigners draining out of the already small buyer pool, we may yet see worse losses in Prime areas in the year to come.

The main selling point here is the low-density environment of Wishart Road.

This is a very quiet and private area, sitting at the foot of Mount Faber Park (the entrance to the park is just a few minutes walk from this condo). It’s also very small (141) units, so the project has some exclusivity.

One other bonus is that, unlike most low-density areas, Foresta @ Mount Faber has access to public transport.

You can walk to Telok Blangah MRT (CCL), which is just one stop from Harbourfront (CCL, NEL). This is also where you’ll find VivoCity, and access to Sentosa.

It’s also pretty nice on long weekends, as you’re one stop from the ferry services to Batam, Bintan, etc.

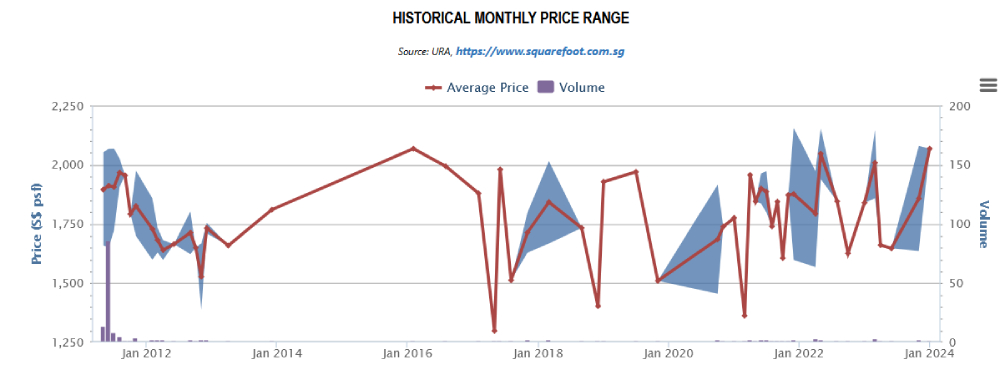

The unprofitable transaction is a chance effect of this condo’s extreme price volatility:

This is quite common in small projects with rare transactions, and we don’t know if any loss was due to issues unrelated to the condo.

Nevertheless, you can see that prices for this development were already high from launch in 2011, with prices hovering around $2,000 psf.

If there is a downside we can see, it’s the relative proximity to a place of worship, which some buyers dislike, and the proximity to a nearby budget hotel.

Some buyers associate such hotels with vice activities, whether or not that actually happens.

Newton Edge has a convenient location, being close to United Square Mall as well as Newton MRT (DTL, NSL). The walk does involve crossing major roads though, so it may not be great for the children and elderly.

Nonetheless, we probably don’t need to explain that the Newton area is packed with amenities, and the famous Newton Hawker Centre is a great supper spot*.

It’s also close to the city centre, for those who require CBD access. For families, there’s a tough tradeoff here:

On the one hand, Newton is not exactly a family area with big green spaces to enjoy.

In fact, it’s one of the worst areas for traffic noise and congestion, and has been since before WWII (it’s been the convergence point of eight roads since the 1930’s).

On the flip side, condos like Newton Edge are close to ACS Junior and Primary, as well as St Joseph’s Institution. Some families appreciate this (plus access to town) more than a park.

Newton Edge has a very small unit count of 103 units and few transactions; so again, we see some extreme price volatility at work, which accounts for the occasional big loss:

The prices at Newton Edge may have also been impacted by increased supply in the area, particularly with the arrival of The Atelier and Kopar at Newton in recent years.

*Or maybe you think Newton hawker centre has become overpriced and touristy; we’ll leave that to your opinion!

Before we dive into this project, we need to explain something important — 8 Saint Thomas launched in a very odd way.

There was no "under construction" period, as it was launched upon TOP; this meant no progressive payment scheme, and buyers could move in right after buying.

Being fully completed may have contributed further to its high price at launch (as it’s already considered a luxury property).

Certainly, it was pricier than many other River Valley options at the time of its launch. This project was already at around $3,218 psf when it launched in 2018, which is no small amount even for River Valley.

In any case, this project is about equidistant between Somerset MRT (NSL) and Great World MRT (TEL).

This is close to the heart of the Orchard shopping belt, so there’s no shortage of food, retail, and entertainment (albeit of the pricier variety, given the location).

One advantage is that 8 Saint Thomas is near the main shopping belt without being directly on it, which spares it from the noise and traffic of this area.

That said, this project has an issue with differentiation. River Valley is simply crammed full of similar luxury condos; and while this one is nice, it doesn’t really stand out from competitors, despite often being pricier.

Another issue could be due to the smaller unit size per unit type, which isn’t as popular in a prime area where affordability isn’t as big an issue.

This is the residential segment of Marina Bay Financial Centre (MBFC).

This project’s main appeal — besides the high-end amenities of the Marina Bay area — is the waterfront view on one facing, and the view of the Singapore city skyline on the other.

Note that being part of MBFC means there’s a connection to Downtown MRT (DTL).

This project clearly has an investment angle, as it’s perfect for tenants who work in the finance industry (although mind you, not every tenant considers it a pleasure to be that close to the office after work).

For families, this would frankly strike us as a strange choice. There aren’t any schools nearby, and while it’s very accessible, the amenities nearby are all high-end restaurants and designer stores.

However, own-stay use may be plausible for a young couple, or lifelong singles with a higher income.

This transaction in particular was sold after just a year, so the seller would have incurred a steep SSD. There’s no clear downside that would explain a big losing transaction here, so it’s likely due to the seller’s own motives.

This one gives us a sense of deja-vu, as we write about it in January 2024.

Marina One had a strange launch: it saw a strong response during preview sales, moving around 300 units with many foreigners buying units in bulk.

But during its official launch weekend, the Singaporean public seemed to shun it, and only 20 units were sold.

At the time, analysts blamed it on the ABSD recently being raised to 15 per cent for foreigners. Now that the ABSD was raised to 60 per cent last year, we wonder how rough things might get on the resale front.

That aside, Marina One Residences has suffered from lacklustre performance over the years:

The average price has dipped to $2,176 psf, down from $2,556 in 2019; and there’s a record of 17 profitable transactions to 220 unprofitable ones.

One of the complaints we’ve heard is that Marina One is on the outskirts of the CBD where, outside of office hours, everything can go dead.

It also may not help that the nearest mall (besides the commercial elements in Marina One itself) is probably Marina Bay Sands or the commercial parts of MBFC — and as we pointed out above, these aren’t really places for day-to-day needs.

Another one is the internal facing of the development. While the inside does look futuristic and interesting, a common comment is that it is dark and not everyone wants to face the office blocks.

Speculatively, the recent low bid for Marina Gardens Crescent site may be influenced by the numbers we’re seeing here. It does seem like it would make a prospective developer nervous.

ALSO READ: 4 most expensive condos in Bugis: Is this the next most prestigious place to live in Singapore?

This article was first published in Stackedhomes.