The Arden sells 26% of units at attractive average price of $1,750 psf

The sales weekend of The Arden on Aug 12-13 saw a take-up rate of 26 per cent at an average price of S$1,750 psf.

The 105-unit project is a boutique development along Phoenix Road near the Choa Chu Kang and Bukit Panjang neighbourhoods. It is an enbloc site of a row of apartments and shops along Phoenix Road, which developer Qingjian Realty acquired for S$42.6 million in 2019.

According to Qingjian Realty in a press release, The Arden saw a positive response from prospective buyers on its booking day. 68 individuals expressed keen interest, while 36 potential buyers participated in the balloting exercise. Eventually, 27 out of 105 units were snapped up.

The Arden's average sale price is one of the most affordable private residential new launches in the Outside Central Region (OCR) this year. Several units were also priced below S$1,700 psf.

Ismail Gafoor, CEO of PropNex, says, "Having purchased the site back in 2019 when land cost was perhaps a bit more manageable, the developer likely has some flexibility in its pricing strategy amid today's high cost environment. We have seen a number of new OCR launches transacting at prices over S$2,000 psf, and The Arden would represent a value-buy for many owner-occupiers, including HDB upgraders."

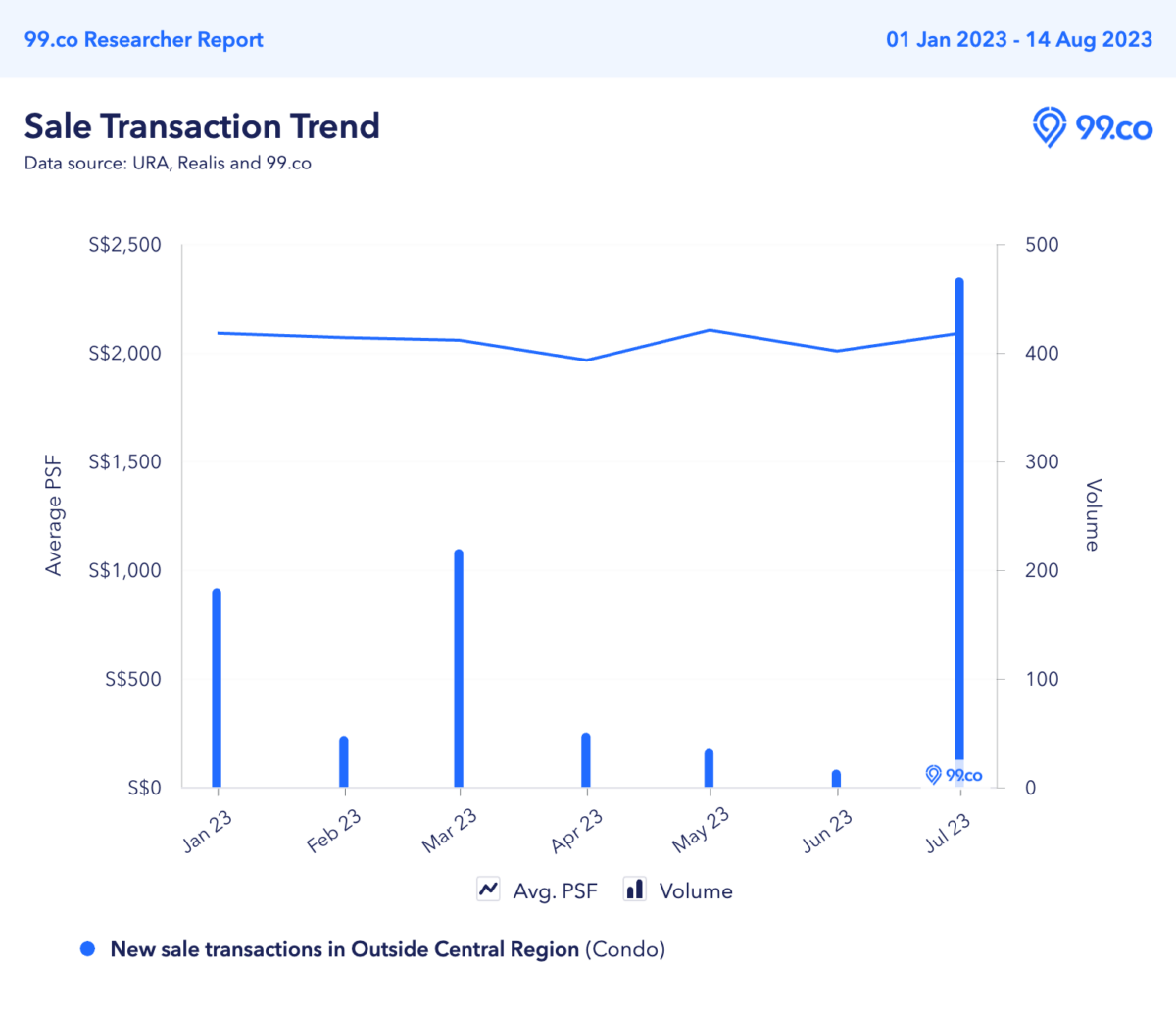

The average price of new sale transactions in the Outside Central Region (OCR) is S$2,073 psf from January to July 2023.

According to Qingjian Realty, The Arden's two-bedroom units were the most popular among buyers. three-bedroom and four-bedroom units also "enjoyed a steady and substantial demand," with a majority of them "acquiring the units for their own stay."

"The response we've received for The Arden has been remarkable. The demand showcases the appeal of our meticulously designed living spaces and the value we offer to our customers," says Ouyang Jing, General Manager of Qingjian Realty.

One of The Arden's unique selling points is its CoSpace concept in several three and four-bedroom unit types. Buyers are able to have flexible unit configurations as they can customise their living spaces based on their preferences at any stage of their lives.

Furthermore, standard units at The Arden come with a high ceiling of 3.2m, while penthouses enjoy 4.6m.

Marcus Chu, CEO of ERA Singapore, notes that The Arden is "a compelling choice for homebuyers and investors" as it has an "attractive pricing and well-thought-out" features. It is also in "a strategic position to enjoy the benefits of living close to the upcoming Jurong Innovation District (JID) and Jurong Lake District (JLD)."

During The Arden's launch weekend, two other projects, TMW Maxwell and Orchard Sophia also launched for sale. TMW Maxwell sold seven out of 80 units (nine per cent) which were released, at an average price of S$3,310 psf. Meanwhile, Orchard Sophia sold 19 out of 78 units (24 per cent), at an average price of S$2,800 psf.

The combined sales of 53 units last weekend were more muted than previous weeks' launches. For instance, on the weekend of August 5-6, Altura EC sold 220 out of 360 units with a take-up rate of 61 per cent. In July, Grand Dunman sold 550 out of 1,008 units with a take-up rate of 54 per cent.

PropNex's Gafoor attributes this to a "choice paralysis" as "buyers are spoilt for choice in today's market, with more than 2,500 units (excluding ECs) still unsold from recently launched projects since April. Faced with so many options, understandably buyers will need more time to come to a decision."

In July and August this year, there were nine new launches. Although they have distinct concepts and price points targeting different segments of buyers, there's less urgency to purchase a new condo during its launch weekend.

ERA's Chu notes that, "While genuine buying demand remains resilient, we do see increasingly more homebuyers making their rounds to consider various options before returning to pick up a unit in the project of their choice."

With the Hungry Ghost Festival happening from Aug 16 to Sept 14, we don't foresee that there will be any new launches soon. There might also be a slowdown in the sales of new launches during that time period.

Based on Huttons' private residential market report in Q2 of 2023, "there may be up to 21 new launches with a total of 6,969 units in the second half of 2023. This will bring launched units to an estimated 10,655 for 2023."

Here are some potential major new launches later this year:

Although a higher supply of new launches may stabilise prices, PropNex's Gafoor cautions that "sales at future new launches could experience some friction owing to the wider availability of options for buyers, particularly if there are ample unsold supply in the vicinity."

ALSO READ: Here are the new launch condos approaching their developer ABSD deadlines in 2023/24