How Singapore's new rental rules may benefit landlords (and tenants)

Sometimes, we need to remember who depends on who, when it comes to foreign workers.

Domestic helpers aside, I’m also talking about foreign workers of the non-Sentosa-Cove variety. From Malaysia, India, Bangladesh, Myanmar, Indonesia, etc., we rely on foreigners for several key positions; be it nursing, or keeping those 24-hour supper spots running.

So it’s a good thing the government does care about the sort of rent they’re paying.

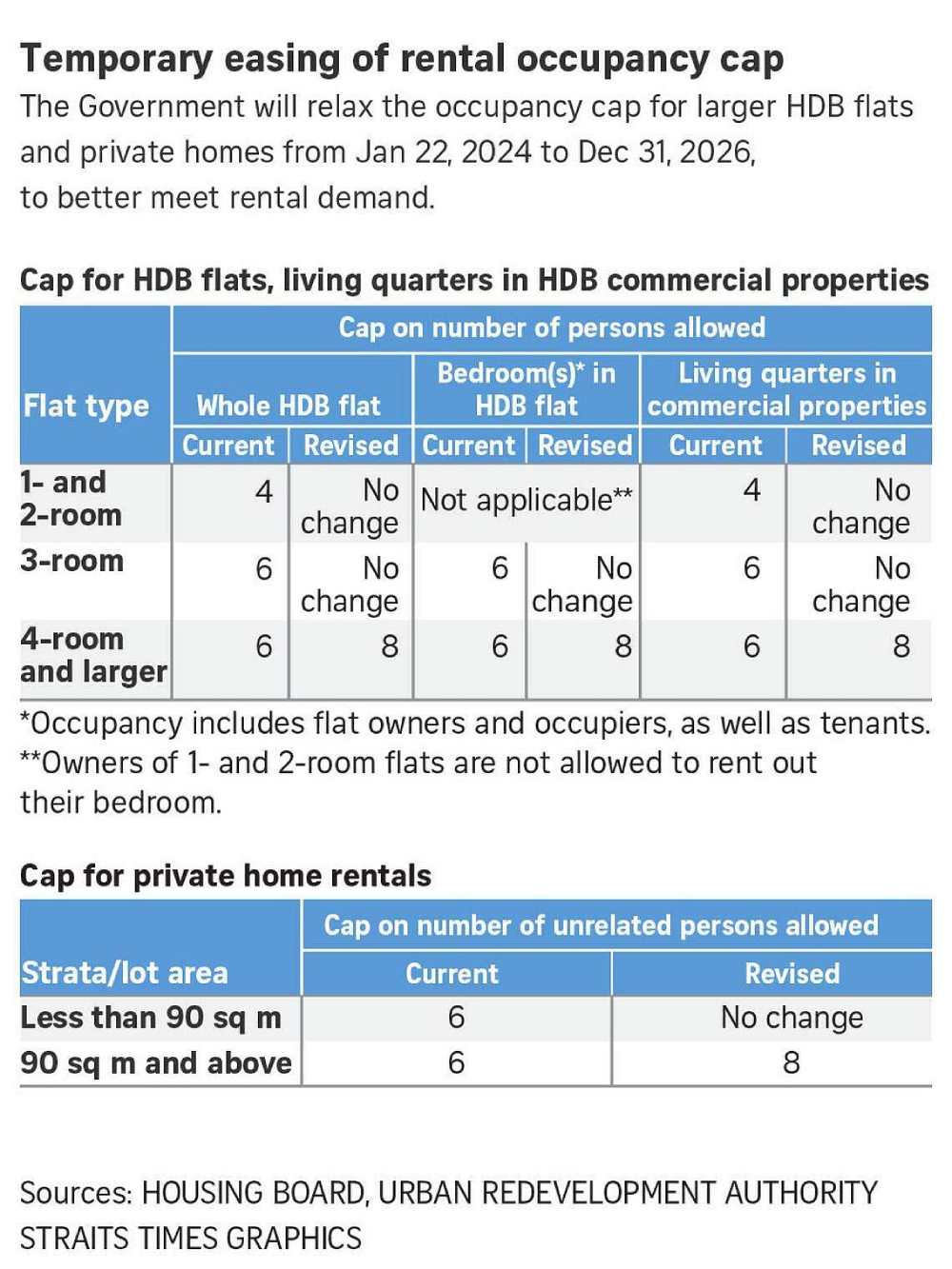

The new occupancy limits, which apply to both private and HDB units, increase the number of unrelated tenants allowed in the same unit.

This doesn’t just help Singaporean renters, who are escaping tough home situations, waiting for their flats to be built, etc. It also helps foreign workers, who aren’t all affluent expats.

The new occupancy limits are:

A switch to eight unrelated tenants makes a huge difference, to tenants splitting the rent. Assuming $3,500 to rent a flat, six tenants splitting it is roughly $583 per person*.

Split eight ways they’ll average $437.50 each. For a foreign worker in a zhi char stall/small restaurant, where wages may be just $1,200 a month, that’s a difference of about 12 per cent of their monthly wage.

Of course, it does come with the discomfort of more housemates.

*Don’t take this literally — some tenants will pay more for bigger rooms, for example; but you get the general idea.

With more tenants, a landlord could inch up rental rates by a smaller amount, and count on the one or two more tenants to balance this out.

If a landlord wants to push the rental from $3,500 to $4,000 a month, for instance, it may be viable to maintain the rental rates of six existing tenants, while making up the difference with one more new tenant.

This may result in a bit less space, but some tenants would be happy to make the compromise if it means no rental increases.

Also, the rule changes are only being applied to the larger flats (four-room and up), so landlords can’t do the inhumane thing and try to stuff eight people into a three-room flat.

On the flipside, co-living companies will probably be overjoyed at this news — as with landlords who prefer to rent out room by room to maximise their rent.

As I recently wrote about a reader who shared their conversion story of a three bedder into a four bedder dual key, this move would definitely benefit landlords that do so.

If businesses can’t afford to house their employees, or foreign workers go elsewhere because rent’s unmanageable, we all lose out in the long run.

And just in case anyone is thinking "Come on Ryan, as if it’s so high they won’t work here anymore", here’s a reminder that the current rental record for a five-room flat is $7,600 a month.

If that were your monthly loan repayment for a condo, you’d need to earn $13,820 per month just to qualify for it.

Foreign workers aside, what about Singaporeans who do need to rent? There’s a much greater strain on our social support system, if rent becomes so high that more families need rental flats; or if people are forced to stay in dysfunctional home environments.

Remember that, during the post-pandemic era, we spent 2.9 per cent of our GDP just on handling depression.

Those kinds of health problems tend to rise when people literally can’t find a space of their own.

We need to rethink the assumption that, just because 90 per cent of Singaporeans own their homes, it’s somehow irrelevant how hard we squeeze the remaining 10 per cent.

| PROJECT NAME | PRICE $ | AREA (SQFT) | $PSF | TENURE |

| WATTEN HOUSE | $14,391,000 | 5177 | $4,080 | FH |

| MIDTOWN MODERN | $4,118,000 | 4166 | $1,464 | 99 yrs (2019) |

| 19 NASSIM | $3,829,000 | 1539 | $1,109 | 99 yrs (2019) |

| THE REEF AT KING’S DOCK | $3,253,840 | 1841 | $1,249 | 99 yrs (2021) |

| J’DEN | $3,148,000 | 2863 | $1,259 | 99 year |

| PROJECT NAME | PRICE $ | AREA (SQFT) | $PSF | TENURE |

| PINETREE HILL | $1,322,640 | 538 | $2,458 | 99 yrs (2022) |

| GRAND DUNMAN | $1,374,000 | 549 | $2,503 | 99 yrs (2022) |

| THE LANDMARK | $1,412,601 | 495 | $2,853 | 99 yrs (2020) |

| THE MYST | $1,493,000 | 678 | $2,202 | 99 yrs (2023) |

| THE CONTINUUM | $1,528,000 | 560 | $2,730 | FH |

| PROJECT NAME | PRICE $ | AREA (SQFT) | $PSF | TENURE |

| CORALS AT KEPPEL BAY | $8,400,000 | 3025 | $2,777 | 99 yrs (2007) |

| THE ORCHARD RESIDENCES | $8,300,000 | 2465 | $3,367 | 99 yrs (2006) |

| PATERSON SUITES | $4,400,000 | 1679 | $2,620 | FH |

| VIVA | $3,800,000 | 1518 | $2,504 | FH |

| THE OCEANFRONT @ SENTOSA COVE | $3,650,000 | 2056 | $1,775 | 99 yrs (2005) |

| PROJECT NAME | PRICE $ | AREA (SQFT) | $PSF | TENURE |

| JUPITER 18 | $710,000 | 409 | $1,736 | FH |

| THE TAPESTRY | $725,000 | 441 | $1,643 | 99 yrs (2017) |

| TROPIKA EAST | $728,000 | 474 | $1,537 | FH |

| MY MANHATTAN | $778,888 | 506 | $1,540 | 99 yrs (2010) |

| THE TAPESTRY | $815,000 | 474 | $1,721 | 99 yrs (2017) |

| PROJECT NAME | PRICE $ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| THE HACIENDA | $3,400,000 | 1894 | $1,795 | $1,250,000 | 17 Years |

| SPRING GROVE | $3,180,000 | 1668 | $1,906 | $1,050,000 | 22 Years |

| VIVA | $3,800,000 | 1518 | $2,504 | $2,330,580 | 14 Years |

| CLAREMONT | $2,450,000 | 1119 | $2,189 | $1,000,000 | 24 Years |

| PATERSON RESIDENCE | $3,300,000 | 1313 | $2,513 | $1,987,200 | 18 Years |

| PROJECT NAME | PRICE $ | AREA (SQFT) | $PSF | RETURNS | HOLDING PERIOD |

| V ON SHENTON | $2,600,000 | 1356 | $1,917 | -$749,500 | 1 Year |

| THE GLADES | $900,000 | 581 | $1,548 | -$40,000 | 10 Years |

| EON SHENTON | $1,170,000 | 538 | $2,174 | -$40,000 | 6 Years |

| DEVONSHIRE 12 | $985,000 | 452 | $2,179 | $5,000 | 5 Years |

| SKYSUITES@ANSON | $953,000 | 366 | $2,604 | $31,600 | 6 Years |

ALSO READ: Number of tenants allowed in larger properties to be raised temporarily

This article was first published in Stackedhomes.