PUBLISHED ONMarch 25, 2024 12:00 AMBySophie Hong

PUBLISHED ONMarch 25, 2024 12:00 AMBySophie HongBuying an HDB home is an exciting journey for many Singaporeans.

However, with so many factors to consider - price, location, waiting times and more - it can quickly become overwhelming for some of us.

To help you along, we spoke to some Singaporeans about their concerns and considerations when it comes to buying their first home.

Then, we'll guide you through the support available for first timers, such as the grants and loans available. We'll also share some handy tools and resources to smoothen your housing journey.

After all, your first HDB home should be a joyous milestone - not a stressful experience!

"I am not sure if there are HDB flats within my budget"

Among the Singaporeans we spoke to, most mentioned that cost is at the top of their minds when it comes to buying an HDB flat.

Bea, a 23-year-old writer, is well aware that housing is a big investment.

"That said, I do think that HDB flats are the most affordable option for Singaporeans, especially for young couples given the available grants," she says.

For young homebuyers such as Bea, a Build-To-Order (BTO) flat is usually the best option given their lower price points. For example, at the recent February 2024 BTO sales launch, prices of flats in non-mature estates ranged from $202,000 to $296,000 for a 3-room flat and $300,000 to $432,000 for a 4-room flat.

If you're a first-timer couple buying a BTO flat, you could tap on the Enhanced CPF Housing Grant (EHG), which applies to any flat type in any estate. The amount you receive depends on your household income - for example, first-timer couples with a combined monthly income of $1,500 or less could be eligible for a grant of $80,000.

Considering a resale HDB flat instead? While they generally cost more than BTO flats, there are also additional grants available for first-timer couples. In fact, the grants can total up to $190,000.

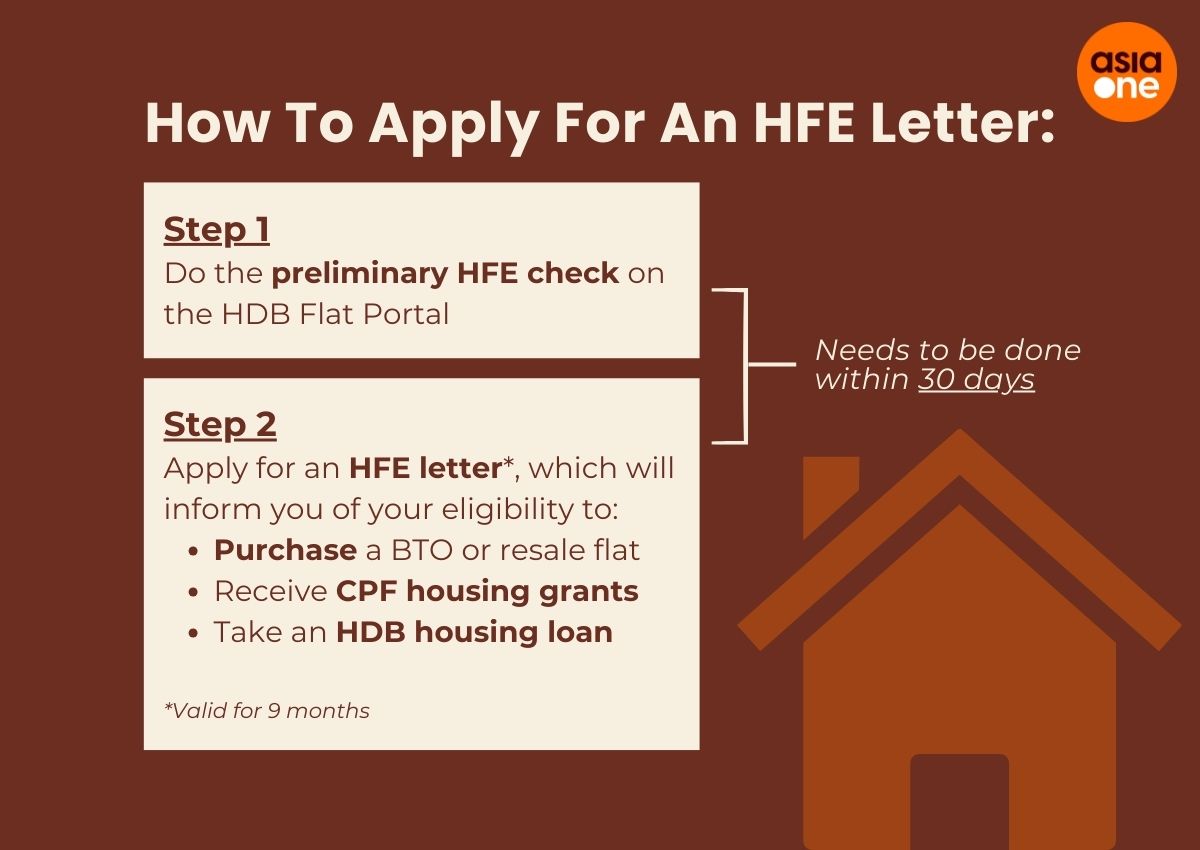

Tip: Ready to start looking? Apply for an HDB Flat Eligibility (HFE) letter first!

Your HFE letter will inform you of your eligibility to buy an HDB flat, as well as the exact amount of grants and HDB loan you can get - but we'll come back to this later.

Once you have those numbers, you can use HDB's Budget Calculator to work out your housing budget, rather than relying on rough estimates. Having a definite number in mind will streamline your search, ensuring a smooth start to your housing journey.

Apply for your HFE letter now on the HDB Flat Portal.

"I can't get an HDB flat in a good location"

Another common concern was not being able to get a flat in a good location.

But what makes a "good" location, exactly?

Traditionally, HDB flats in mature estates - such as Bishan, Toa Payoh and Bukit Merah - tend to command higher prices due to their popularity. This is because these estates are more centrally located and presumably, closer to amenities.

But non-mature estates - such as Punggol, Sengkang, and Yishun - have become more developed over the years too, with better connectivity and amenities. This means the distinction between mature estates and non-mature estates has blurred over the years.

From the second half of this year, HDB will be doing away with the current mature and non-mature estates classification system. This will be replaced by a new classification system which differentiates BTO projects by locational attributes.

Under the new classification, new BTO projects will be classified as either Standard, Plus, or Prime.

Standard flats will form the bulk of the new flat supply, and come with standard subsidies and conditions.

Plus flats refer to flats in choicer locations within each town, such as those closer to amenities like MRT stations or town centres. To keep Plus flats affordable, HDB will price these flats with more subsidies. At the same time, to make the scheme fair, these flats will also come with tighter sale conditions, such as a 10-year MOP and subsidy recovery on the resale price.

Prime flats refer to flats in prime and central locations - these flats are currently being launched under HDB's Prime Location Public Housing (PLH) model. Considering their high market value, Prime flats will be priced with the most subsidies of the three categories, to keep these flats affordable. Their sale conditions will also be the tightest, including a higher subsidy recovery on the resale price.

What this means is that public housing will remain affordable, inclusive and fair, due to the additional subsidies from HDB for projects in more in-demand locations.

Tip: At the end of the day, a good location means different things to different people. Take some time to consider your needs and preferences - this can help to refine and focus your search for an HDB home.

In fact, most of the people we spoke to said that living near the city is not a top consideration.

Instead, their top three considerations are price, proximity to family, and nearby amenities.

In the Dinner Talks video, first-timer couple Daryl and Gwen shared that they chose a BTO project in Tampines due to the children-friendly amenities and schools nearby. Plus, there is the bonus of being close to both their parents who are residing in the East.

On the other hand, retired couple Ahmad and Nurijah decided to move out of Tampines and are now happily settled in their new home in Woodlands. Although they now live farther from the city, their HDB flat is conveniently located near the Woodlands town centre and MRT station, so everything they need is within easy reach.

It was a trade-off that the couple was willing to make. Their current flat in Woodlands costs less than their old Tampines flat, and they were able to use the sale proceeds to cover their renovation costs and bolster their retirement savings.

As you explore your options, don't forget to refer to the maps on HDB Flat Portal and the URA master plan to get a better idea of the existing and upcoming amenities. These resources will help as you figure out how best to balance your wants and needs.

Still weighing your options? Here's a piece of advice from Ahmad and Nurijah: "Keep your mind open to options that meet your budget and needs."

"BTO flats are always oversubscribed"

Content specialist Sofia and her fiance first applied for a BTO flat in 2020 but were unsuccessful in getting a queue number due to the high number of applicants for that project. It took three more times before they successfully secured their BTO flat.

"We were applying for BTOs near the city, which were highly sought after," recalls the 28-year-old. The young couple maintained realistic expectations and were prepared for the possibility that they might not succeed in their application.

"Both of us were still studying at that time so there wasn't any immediate urgency," she says, adding that they got smarter with the subsequent applications. She and her fiance subscribed to HDB's eAlert service so they wouldn't miss a BTO launch, and prepared all the required documents ahead of time to save themselves the hassle of looking for the documents again when applications opened.

If you're planning to BTO soon, the good news is that around 19,600 BTO flats are set to launch this year.

In fact, HDB has increased the supply of BTO flats in recent years to meet housing demand, and it is on track to offer a total of 100,000 new flats from 2021 to 2025.

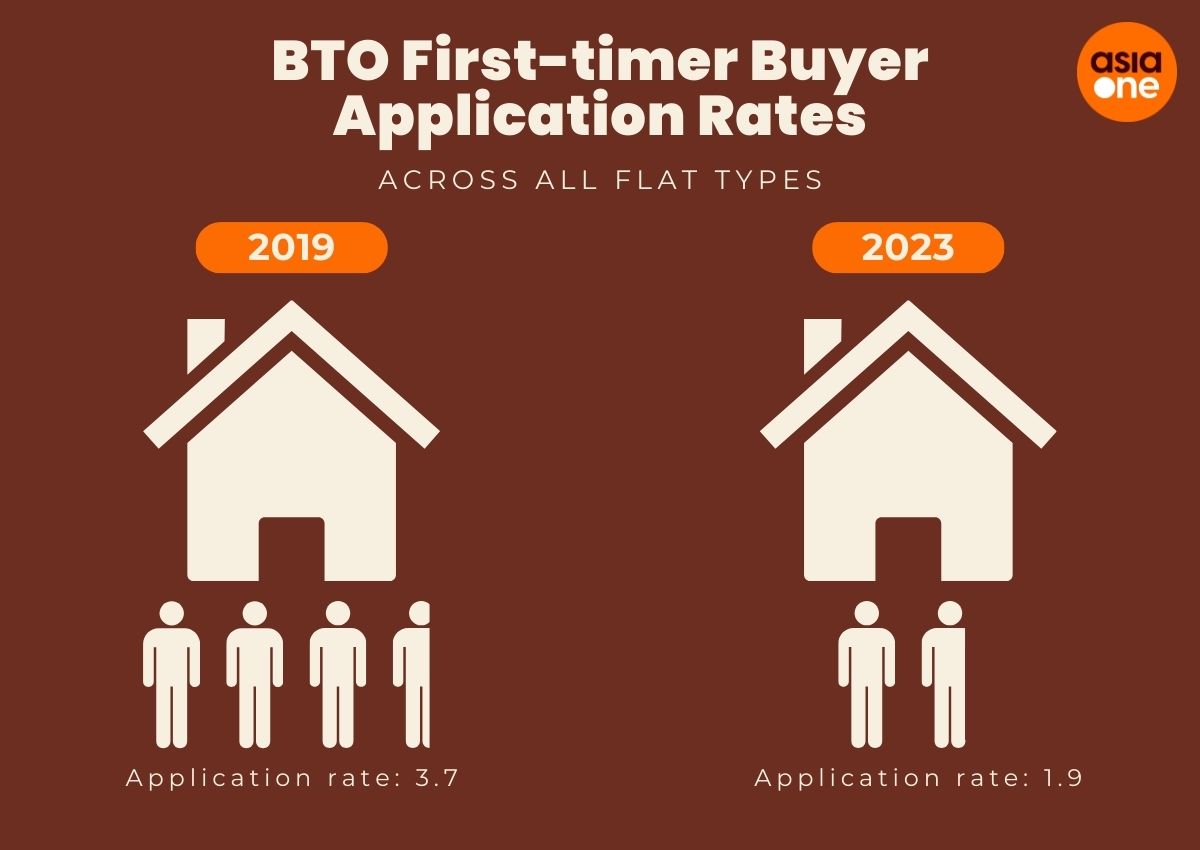

And here's some even better news. BTO application rates have steadied, which signals that there are now fewer folks vying for each flat. Last year, first-timer buyer application rates across all flat types dropped to 1.9, a significant decrease from the pre-pandemic rate of 3.7 in 2019.

This means your odds of successfully balloting for a BTO flat are promising!

Tip: To boost your chances, consider projects with lower application rates. To check the application rates, head over to the HDB Flat Portal during the application period - it's updated several times a day.

"The waiting times for BTO flats are long"

Another common concern amongst the people we have spoken to is the wait for a BTO flat, with most agreeing that the waiting times are too long.

The reality is the median waiting times for BTO flats have reverted to the pre-pandemic norm of three to four years. On top of that, most BTO flats launching this year will have waiting times of four years or less.

HDB has also delivered about 80 per cent of the projects delayed by Covid-19 as of end-December 2023, with the remaining flats slated for completion by next year.

Tip: Want to move into your new home sooner? Consider applying for a Shorter Waiting Time (SWT) flat! There will be 2,800 SWT flats available this year, all with waiting times of less than three years.

"So much paperwork"

If the thought of starting the paperwork for your flat application is making your head spin, you're not the only one.

Overwhelming, tedious and confusing - these were just some of the adjectives used by the people we spoke to regarding the administrative process of buying their first HDB home.

And it's understandable. Previously, buyers had to undergo three different assessments at various stages of the housing journey, which translates to three rounds of document submissions.

"The old process was very tedious and stressful," says Lionel, 24, a digital content creator. "There was a lot of confusion regarding what was required; there are unofficial Telegram groups for every BTO project, and we tried to help each other out."

"But often times, everyone is unsure of how to proceed," he recalls.

With the implementation of the HFE letter, these three assessments are now streamlined into just one - which makes the whole flat buying process considerably easier.

And as mentioned earlier, the added advantage of the HFE letter is that it lets you know your eligibility to purchase a BTO or resale flat, CPF housing grant amounts and HDB housing loan amount upfront.

If you are interested in taking up a loan from a financial institution (FI), you can also concurrently apply for an In-Principle Approval from participating FIs when applying for an HFE letter. The letter will also give you an indicative loan assessment. This will then give you a more holistic view of your housing and financing options.

Just take note that a valid HFE letter is required when you:

- Apply for a flat during a BTO/SBF sales exercise or open booking of flats

- Obtain an Option to Purchase from a seller for a resale flat and when you submit a resale application to HDB

Tip: If you intend to buy a flat, be sure to apply for your HFE letter first! This is because it takes about a month - or more during peak periods - to process. The HFE letter is valid for nine months, which gives you ample time to find the flat of your choice.

There is an HDB flat for every budget and need

While sensational headlines on housing may grab attention, there is a wide range of HDB flats available for every budget and need. And as demonstrated above, there is also plenty of support in place for Singaporeans buying their first home.

Ready to start building your dream home? Visit the HDB Flat Portal for a vast suite of useful tools and resources, including calculators and other key information you'll need for a smooth housing journey.

This article is brought to you in partnership with Housing & Development Board.

sophie.hong@asiaone.com